Alliant Mobile Banking

6.0.9 by Alliant Credit Union (0 Reviews) November 19, 2025Latest Version

6.0.9

November 19, 2025

Alliant Credit Union

Finance

Android

0

Free

org.alliant.mobile

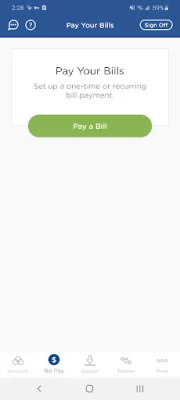

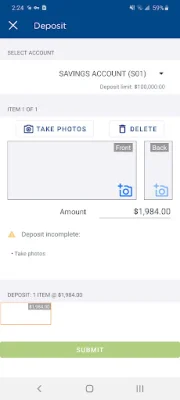

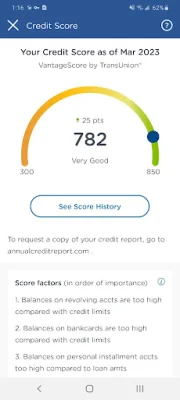

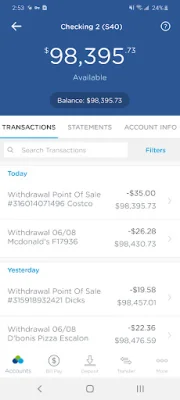

Report a Problem

More About Alliant Mobile Banking

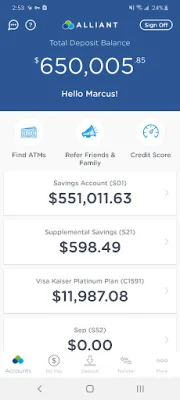

The Alliant Mobile Banking App allows you to conveniently access your online banking account using your existing login credentials or by creating a new account directly from the app. With this app, you can easily deposit checks, check your account balances and recent activity, view transaction history, transfer money between accounts, and report lost or stolen cards. You can also pay bills, find fee-free ATMs, and manage your finances using the personal financial management tool. Some of the highlighted features of the app include fingerprint authentication for easy login, balance preview before logging in, customizable account order, and built-in help for quick answers. The app is compatible with devices using Android 9.0 or higher and all transactional data is encrypted for security purposes. No sensitive account information is stored on your mobile device. In order to find ATMs, the app requires location permissions, and camera permissions are needed for check deposits. It is important to note that there are deposit limits and other restrictions that apply to the mobile check deposit service, and some features may only be available for eligible members and accounts. While there is no charge from Alliant to use the app, message and data rates may apply. Transactions at other ATMs may be subject to surcharge fees from the ATM owner, so it is recommended to use the online ATM locator or the app to find fee-free ATMs or those that accept deposits. It is also important to follow Alliant Credit Union's Funds Availability Policy and retain your checks for 90 days before destroying them. If you have any questions or need assistance, you can contact Alliant Credit Union through their website or by calling their 24/7 customer service line. They can also be reached on social media platforms such as Twitter. Overall, the Alliant Mobile Banking App offers a convenient and secure way to manage your finances on-the-go.

Rate the App

Popular Apps