Aqua credit card

2025.47.1 by NewDay Ltd (0 Reviews) December 02, 2025Latest Version

2025.47.1

December 02, 2025

NewDay Ltd

Finance

Android

0

Free

com.fd.accessplusecs.aqua

Report a Problem

More About Aqua credit card

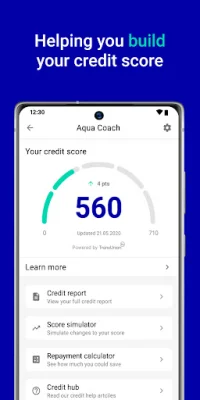

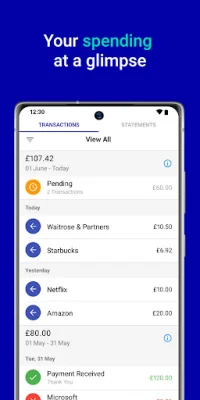

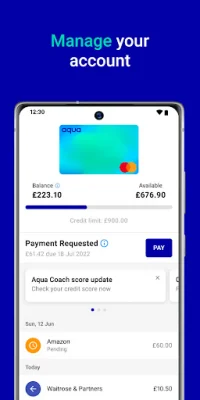

The Online Account Manager app allows you to easily manage your account and stay on top of your finances. With this app, you can conveniently view your latest balance and available credit limit, as well as your latest transactions, including those that are still pending. This gives you a clear understanding of your current financial standing and helps you plan your budget accordingly.

In addition to viewing your account information, the app also allows you to take action on your account. You can make payments directly through the app, saving you time and hassle. You can also set up or manage your Direct Debit, making it easier to stay on top of your bills and avoid late fees.

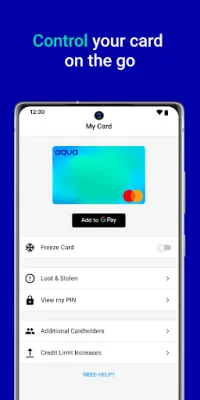

The app also offers features to help you personalize your account. You can manage your statement preferences, choosing to receive your statements electronically or by mail. You can also update your contact details, ensuring that you always receive important account notifications and updates.

For any questions or concerns, the app provides easy access to contact the company and view their FAQs. This allows you to quickly get the information you need and resolve any issues that may arise.

If you're already registered for the Online Account Manager, you can simply use your existing login details to access the app. There's no need to re-register, making it even more convenient to manage your account on the go.

If you're not yet registered for the Online Account Manager, you can easily do so through the app. Simply download the app and click on the "Register for Online Account Manager" button. You'll need to have your last name, date of birth, postcode, and either your card details or account number on hand to complete the registration process.

Finally, the app also offers the opportunity to apply for a personal loan. If you're eligible, you may receive an invitation within the app to apply for a loan with APRs ranging from 25.9% to 43.9%. A representative example is provided to give you an idea of the potential costs and terms of the loan. This feature provides a convenient way to access additional funds if needed.

Rate the App

Popular Apps