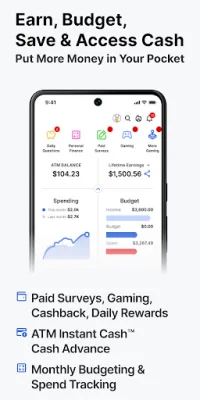

ATM Instant Cash™ & Rewards

2.72.4 by ATM.com, Inc. (0 Reviews) October 25, 2024Latest Version

2.72.4

October 25, 2024

ATM.com, Inc.

Finance

Android

0

Free

com.atm.atm.prod

Report a Problem

More About ATM Instant Cash™ & Rewards

ATM Personal Finance is an application that not only rewards you for using it, but also helps you take control of your finances. It offers a variety of features, including ATM Instant Cash™, smart spend tracking, budgeting tools, and more, all in one convenient place. With this app, you can easily track your spending and gain valuable insights into your cashflow by visualizing your expenses by category or merchant. You can also set customizable budgets to help you manage your finances more effectively, and keep track of upcoming bills and subscriptions.

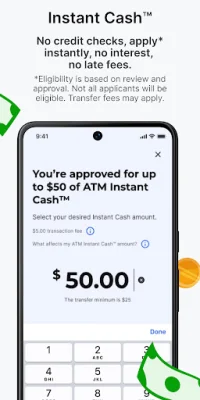

One of the standout features of ATM Personal Finance is ATM Instant Cash™, which provides you with quick access to cash for unexpected expenses. This feature allows you to avoid credit checks, interest, and late fees, and offers cash advance limits ranging from $25 to $200*. However, eligibility for ATM Instant Cash™ is based on review and approval, and not all applicants will be eligible. Transfer fees may also apply.

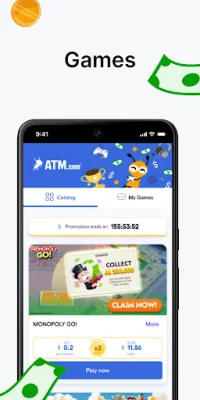

In addition to the financial management tools, ATM Personal Finance also offers opportunities to earn money through the app. Users can play games and earn up to $250 a month, with earnings ranging from $3 to $250 depending on how much they play. The app is constantly working to add more games for users to earn from, making it a great side hustle for gamers.

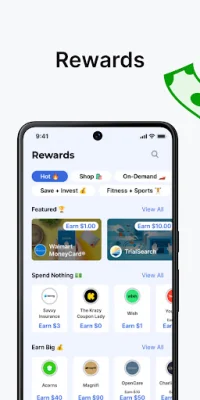

The rewards portal within the app offers over 500 offers for users to earn from, with rewards ranging from $1 to $500. This is an easy way for users to grow their money and increase their earnings.

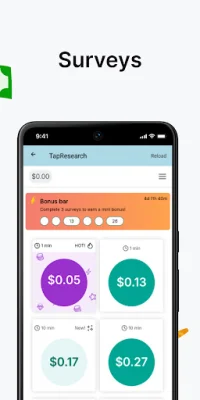

Users can also earn daily by answering a few questions within the app, with nearly a million users already taking advantage of this feature. Additionally, new surveys are added weekly and users can earn anywhere from $0.03 to $5.00 for each survey completed. This is a great way to earn extra cash without receiving gift cards or points.

Finally, ATM Personal Finance offers location rewards, where users can earn passively by sharing their locations and walking into stores. This is a unique feature that sets the app apart from others, and allows users to earn cash without actively completing tasks. To learn more about the app and its features, visit their website at https://www.atm.com/. You can also follow them on social media for updates and promotions on Instagram, Facebook, and Twitter. As with any financial app, it is important to review the disclosures available at https://atm.com/legal-disclaimers/ before use.

Rate the App

Popular Apps