Capital Group PlanPremier401k

v2025.11.19 (2511.19) by Empower® (0 Reviews) November 21, 2025Latest Version

v2025.11.19 (2511.19)

November 21, 2025

Empower®

Finance

Android

0

Free

com.empower.retirement.android.AmFunds.Mobile

Report a Problem

More About Capital Group PlanPremier401k

If you're unsure if this app is suitable for your retirement plan, you can always reach out to your employer for more information. This app offers a variety of features to help you manage your retirement account and make informed decisions about your investments.

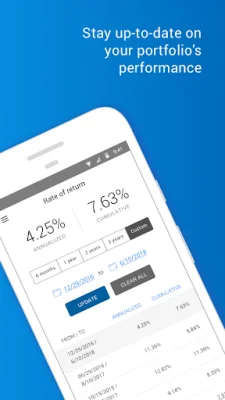

With this app, you can easily view important details about your account, such as a personalized estimate of your monthly retirement income, your personal rate of return, and balances across different investment options. You can also access a summary of your transaction history, see your future contribution allocations, and view your beneficiaries (if available). Additionally, you can use the app to access and download plan forms, as well as upload documents to request certain account changes.

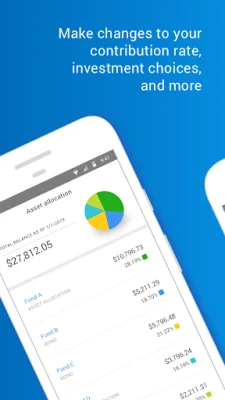

One of the main benefits of this app is the ability to make changes to your account, as allowed by your retirement plan. This includes updating your contribution amount, adjusting future contribution allocations, and exchanging between funds or rebalancing your account. You can also manage your beneficiaries, enroll in your plan, and update your profile, including communication preferences, username, and password. Additionally, you can request a loan and view information about any active loans you may have.

Capital Group, the home of American Funds, has been helping investors achieve long-term investment success since 1931. With this app, you can have peace of mind knowing that your retirement account is in the hands of a trusted and experienced company. So why not give it a try and see how it can help you plan for a secure financial future?

Rate the App

Popular Apps