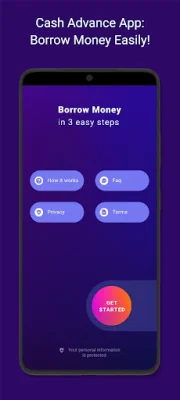

Cash Advance App: Borrow Money

1.0.0 by Fast Cash Advance Apps (0 Reviews) October 25, 2024Latest Version

1.0.0

October 25, 2024

Fast Cash Advance Apps

Finance

Android

0

Free

cash.advance.app.borrow.money.instantly

Report a Problem

More About Cash Advance App: Borrow Money

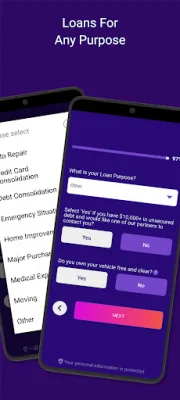

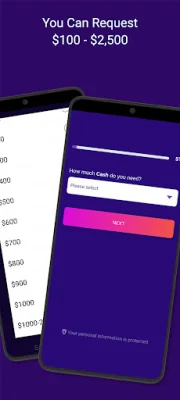

Are you in need of some extra cash but have a poor credit rating? Look no further than our money borrowing app! With just a few simple steps, you can apply for a loan between $100 and $2,500 and receive a cash advance, even with a poor credit score. The entire process can be completed online, making it fast and convenient for those in need of quick financial assistance.

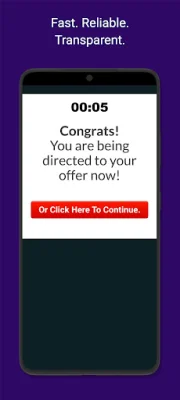

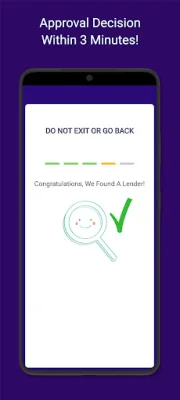

To get started, all you need to do is submit the amount you wish to borrow and your personal information. Within minutes, you will find out if you have been approved for a loan. Once approved, you can digitally sign the contract and receive the funds as soon as the next business day. Our app is available to all legal US citizens over the age of 18 with a monthly income of at least $1,000 and a standard checking bank account.

Our app is designed to make the borrowing process fast and efficient, especially during times of crisis. You can complete the entire application from the comfort of your own home, without the need for any physical paperwork. And the best part? Repayment is made automatically, making it a hassle-free way to get the cash you need.

Even if you have a poor credit score, our app can still help you get the funds you need. Unlike traditional lenders, we do not have a blanket approach to credit scores. Instead, we consider other factors such as employment status and income level when making a decision. This makes it easier for those with bad credit to get approved for a loan.

It's important to note that our app does not function as a lender or loan broker. Instead, we connect borrowers with licensed and accredited cash advance lenders who offer amounts within the requested range. The loan agreement is between the borrower and the lender, and our app simply facilitates the connection. We also adhere to state laws and do not facilitate offers for prohibited loan products.

When considering a loan, it's important to understand the annual percentage rate (APR), which is the yearly interest cost of the loan. Our APR ranges from 6.63% to 35.99%, depending on the lender and other factors. Before accepting a loan, you will be clearly shown the APR and the total cost of the loan. This helps you make an informed decision and understand the total amount you will need to repay.

For example, if you borrow $2,000 over a 2-year period with a 25% APR, the total cost of the loan will be $500, making the total amount to repay $2,500. This would result in a monthly payment of $104.17. So if you're in need of some extra cash, don't hesitate to use our money borrowing app and get the funds you need quickly and easily!

Rate the App

Popular Apps