Cash Advance & Payday Loans

1.11 by Melissa Finance App (0 Reviews) October 25, 2024Latest Version

1.11

October 25, 2024

Melissa Finance App

Finance

Android

0

Free

com.advance.cash.payday

Report a Problem

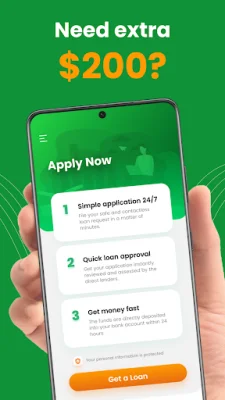

More About Cash Advance & Payday Loans

Our platform connects borrowers with payday loan lenders who are willing to provide loans even to those with bad credit scores. This is a great option for those in need of immediate funds, as it eliminates the need to wait in line at a bank. With our app, you can apply for a payday loan right from your phone and have the funds deposited directly into your bank account. The application process is quick and easy, taking only 5 minutes to complete and requiring no paperwork. We only work with trusted lenders who offer loans with no hidden fees or taxes, and you will receive a fast response directly to your phone. Our services are available 24/7, ensuring that you can get instant loans for any purpose whenever you need them, regardless of your credit score.

So how does our app work? First, you will need to download it and fill out a simple application form with basic information about yourself, such as your name, age, address, place of work, and the purpose of the loan. Our statistics show that 95% of applicants receive their payday advance within 24 hours. Next, you can select the amount of money you need and our app will match you with reliable lenders who offer the best payday loans. It is important to carefully review the loan offer, paying attention to the interest rate and repayment schedule, to ensure that it is the right fit for you. Once you have selected a loan, you will need to sign a contract and agree to the terms and conditions, including what happens if you are unable to make payments on time. Most users receive their funds within 15 minutes, although it may take longer for the funds to be transferred to your bank account.

It is important to note that we are not a direct lender, but rather a platform that works with reputable lenders who are willing to provide loans to our users. By using our app, you agree to have your personal information verified by these lenders. The average loan terms include a minimum repayment period of 65 days and a maximum repayment term of 2 years, with a maximum APR of 35.95% (including fees). For example, if you borrow $2,000 for 6 months with an APR of 30%, you will need to pay back $363.10 each month, for a total repayment amount of $2,178.60, including $178.60 in interest.

If you are unable to make your payments on time, it is important to communicate with your lender and negotiate the terms of your loan, including the possibility of an extension. Most lenders are willing to work with borrowers and offer flexible repayment options, although you may be charged a late payment fee. Our app is dedicated to providing fast and convenient access to funds from the best lenders in the US, at any time of the day.

Rate the App

Popular Apps