First Card

3.11.1 by Nordea Bank Abp (0 Reviews) November 22, 2025Latest Version

3.11.1

November 22, 2025

Nordea Bank Abp

Finance

Android

0

Free

se.nordea.firstcard

Report a Problem

More About First Card

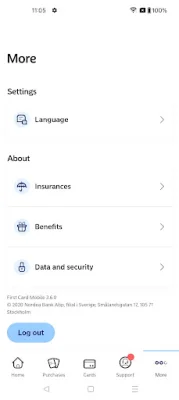

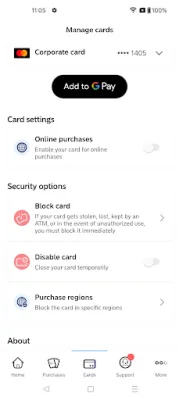

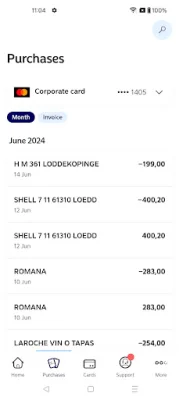

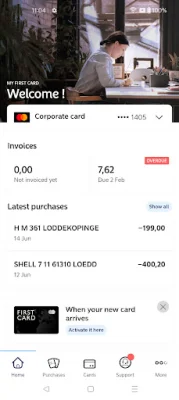

The First Card app allows users to easily manage their credit card account on their mobile device. With this app, users can view both their invoiced and new purchases, making it easy to keep track of their spending. Additionally, the app allows users to manage safety settings for their card, such as enabling online purchases and choosing to block the card for purchases in specific regions. In case the card is lost or stolen, users can also temporarily disable it through the app.

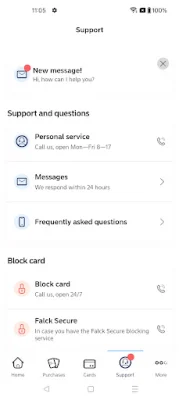

One of the key features of the First Card app is the ability to send secure messages to customer service. This allows users to easily communicate with the company and get any issues or concerns resolved quickly and efficiently. To access all parts of the app, users must log in using their respective country's identification method. Swedish cardholders can use Mobile BankID, Norwegian cardholders can use BankID or Mobilt BankID, Danish cardholders can use MitID, and Finnish cardholders can use bank codes.

Even without logging in, users can still access important contact information, such as customer support, card blocking services, and card insurance companies. This makes it easy for users to quickly take action in case of an emergency or issue with their card. The app also provides a section for frequently asked questions, making it easy for users to find answers to common inquiries.

For those concerned about accessibility, the First Card app has an accessibility statement available on their website. This statement outlines the company's commitment to making their app accessible to all users, regardless of any disabilities or impairments. By prioritizing accessibility, the First Card app ensures that all users can easily and effectively manage their credit card account on their mobile device.

In summary, the First Card app offers a convenient and secure way for users to manage their credit card account on the go. With features such as viewing purchases, managing safety settings, and sending secure messages to customer service, the app makes it easy for users to stay on top of their finances. And with a focus on accessibility, the app ensures that all users can access and use its features effectively.

Rate the App

Popular Apps