RHB Mobile Banking

2.19.1 by RHB Bank (0 Reviews) October 27, 2024Latest Version

2.19.1

October 27, 2024

RHB Bank

Finance

Android

0

Free

com.rhbgroup.rhbmobilebanking

Report a Problem

More About RHB Mobile Banking

The RHB Mobile Banking App is a convenient and innovative way to manage your finances 24/7. With its user-friendly features, you can easily perform everyday banking tasks on-the-go, giving you more time for the things that matter most in life.

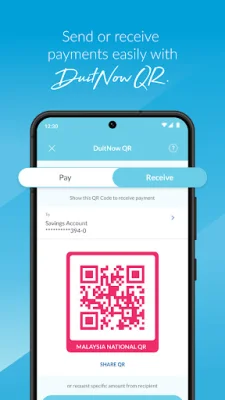

One of the key features of the app is the ability to access important account information with just one quick glance. You can also download e-statements for your accounts no matter where you are, making it easier to keep track of your finances. The app also allows you to make payments to your favorite individuals and bills with just one tap, as well as make QR payments to merchants, friends, and family effortlessly.

Security is a top priority for the RHB Mobile Banking App, which is why it offers secure fund transfers without the need for an OTP. You can also earn RHB Loyalty Points through various transactions and redeem rewards. The app also allows you to make scheduled payments to JomPAY billers and individuals via DuitNow Transfer, ensuring that you never miss a payment with actionable alerts.

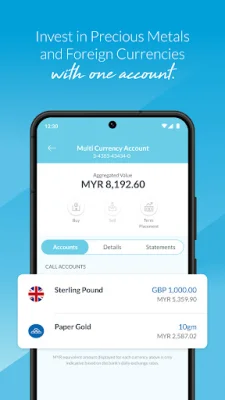

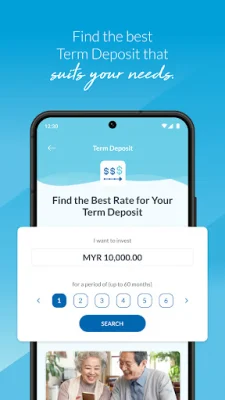

Managing your finances has never been easier with the RHB Mobile Banking App. With just a few taps, you can make term deposit placements or withdrawals, convert to multiple foreign currencies at attractive rates, and top up ASNB funds for yourself and your loved ones. You can even get instant cash from your RHB Credit Card's limit.

The app also allows you to update your account information wherever you are. You can easily change your payment limits, manage your DuitNow account settings, and update your card pin and personal details. And if you don't have access to RHB Online Banking, you can simply download the app and register to enjoy its convenient features.

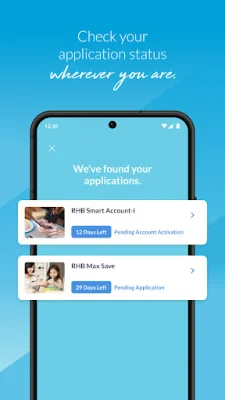

Even if you're not an RHB customer, you can still benefit from the app. You can download it and apply for an RHB Savings or Current Account from the comfort of your own home, with ID verification. This means no more bank visits, just a few clicks and you're all set. Plus, with PIDM protection for up to RM250,000 for each depositor, you can rest assured that your money is safe. However, do note that investment products are not protected by PIDM, so it's important to do your research before making any investment decisions.

Rate the App

Popular Apps