Tellus: Earn More Daily

2.87.0 by Tellus App, Inc. (0 Reviews) November 18, 2025Latest Version

2.87.0

November 18, 2025

Tellus App, Inc.

Finance

Android

0

Free

com.zilly.zilly

Report a Problem

More About Tellus: Earn More Daily

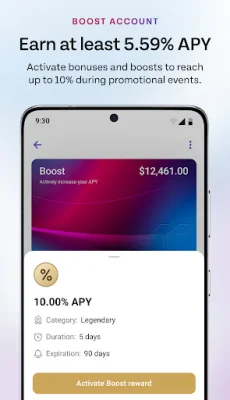

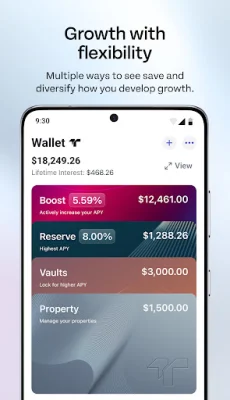

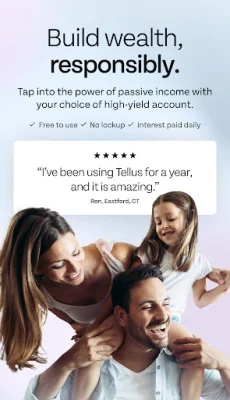

Boost Account is a financial application that allows users to earn high interest rates on their savings. With a minimum balance of $100, users can earn a minimum of 5.59% APY on a maximum balance of $5 million. This interest rate can be increased even further through Boost rewards, allowing users to maximize their earnings every day. The interest is paid out daily, providing users with a steady stream of income. However, it is important to note that Boost Account is not FDIC insured, but is backed by Tellus' balance sheet.

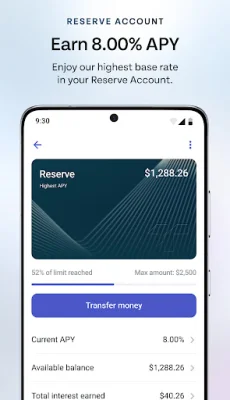

The Reserve Account is another option offered by Boost Account, with a higher interest rate of 8.00% APY on a maximum balance of $2,500. Like the Boost Account, interest is paid out daily and it is also backed by Tellus' balance sheet. This account is a great option for those looking to earn a higher interest rate on a smaller balance.

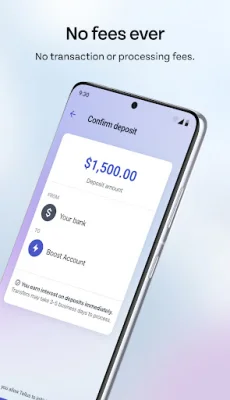

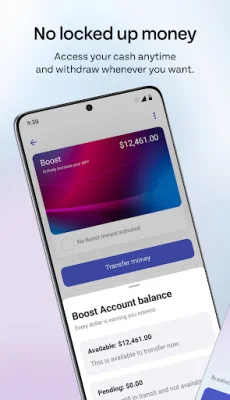

For those looking to maximize their savings, Boost Account offers the option to have both the Boost and Reserve accounts. This allows users to have control over their money while also earning high interest rates. With no lockup periods or penalties for early withdrawals, users can access their cash and withdraw fee-free at any time. Recurring transfers can also be set up to make saving effortless. Additionally, users can start building wealth with just $100.

Boost Account also prioritizes security, using bank-level security (AES-256) to protect user information. The application has received positive reviews from customers, with one user stating that the customer service is the best and the rates are unbelievable.

It is important to note that Boost Account is not a bank and is not FDIC insured. While there are no fees for opening or using the application, users may still be subject to fees from their own bank. Payment solutions are provided by Stripe and Plaid. It is also important to understand that any financial projections or returns shown on the website are estimates and not guarantees of future results. The information provided is not intended to be investment, tax, financial, accounting, legal, regulatory, or compliance advice. Users should always do their own research and make informed decisions when it comes to their finances.

Rate the App

Popular Apps