True Finance: The Money App

8.2.0 by JoinTrueDev (0 Reviews) October 28, 2024Latest Version

8.2.0

October 28, 2024

JoinTrueDev

Finance

Android

0

Free

com.truefinance

Report a Problem

More About True Finance: The Money App

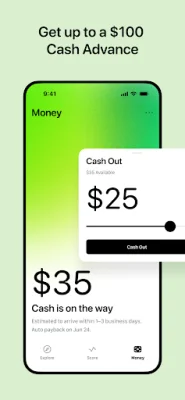

Are you in need of quick cash for gas, bills, or groceries? Look no further than our convenient app, available for download today. Simply connect your bank account and become a member to request an advance and receive funds in just 3 days.

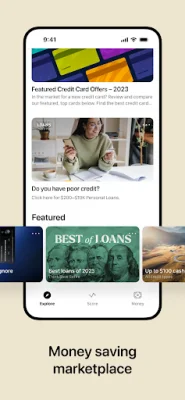

Our app also offers a marketplace for personal loans, auto insurance, and side gigs through our trusted third-party partners. Plus, with our partnership with Array, you can easily view your credit score and report to stay on top of your financial health and protect against identity fraud.

Rest assured that your information and money are safe with us. We use Plaid, a secure platform with 256-bit bank-level security, to connect with over 10,000 banking institutions across the US.

True Finance was founded in 2023 with a mission to assist millions of Americans in need of short-term financial assistance. We also strive to educate our members on their credit scores and how to improve them.

Disclaimer: The APR for short-term, small-dollar financial products may vary and is not determined by True Finance. We are not a lender and do not make individual credit decisions. The APR and loan terms are solely determined by the lender based on factors such as credit score, income, and credit history. Before accepting a loan, the lender is required to disclose the APR and other terms. Some states have laws limiting APR rates and fees that lenders can charge. A representative example is if you borrowed $10,000 with an interest rate of 11.41% over 36 months and a 5% origination fee, your monthly payments would be $347.00 and the total cost of the loan would be $12,480 with an APR of 15.00%. Our loan terms range from 3 to 84 months, and we strive to provide original and SEO-oriented content for our users.

Rate the App

Popular Apps