Trust Bank SG

1.49.0 by Trust Bank Singapore Ltd (0 Reviews) November 25, 2025Latest Version

1.49.0

November 25, 2025

Trust Bank Singapore Ltd

Finance

Android

0

Free

sg.trust

Report a Problem

More About Trust Bank SG

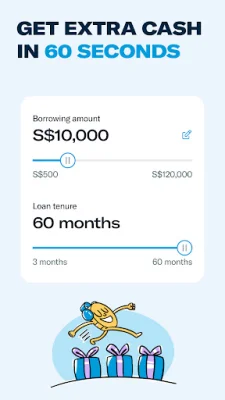

Trust Bank Singapore offers a variety of financial services through their digital card, including cashback, travel benefits, savings accounts, investing, loans, and rewards. Users can easily open an account and receive a digital card within minutes, and can even use Myinfo to pre-fill their application for a Trust card.

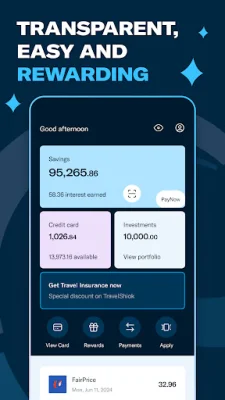

With the Trust card, users can earn up to 15% cashback on their preferred category and 1.0% instant cashback on all other eligible spend. They can also enjoy no foreign transaction fees and transparent exchange rates when using the card for travel. Additionally, NTUC Union Members can save up to 21% with the FairPrice Group, while other users can save up to 15% on everyday needs.

Trust Bank also offers a high-interest savings account and an easy-to-use investment platform with no platform fees or sales charges. Users can start investing with as little as S$100 and have the option to switch between debit and credit with just one tap.

The Trust card also provides a fee-less experience, with no annual fees, foreign transaction fees, or cash advance fees. The savings account has no lock-in period, minimum balance requirement, or monthly fees.

Users can also earn rewards every day with the Trust card, including Linkpoints and coupons at their favorite merchants. The Trust App also has a smart tracker to help users keep track of their rewards in real-time.

Safety is a top priority for Trust Bank, with instant transaction notifications, 24/7 monitoring of transactions and online payments, and strong encryption and biometric login. Customer service is also available 24/7 through in-app chat or phone.

Users outside of Singapore can still access the Trust Bank app by downloading it from the Singapore or any other country's app store where it is available. For more information, visit trustbank.sg.

Rate the App

Popular Apps