Vaulted: Buy Gold & Silver

4.9.1 by Vaulted (0 Reviews) October 29, 2024Latest Version

4.9.1

October 29, 2024

Vaulted

Finance

Android

0

Free

com.vaulted.vaulted

Report a Problem

More About Vaulted: Buy Gold & Silver

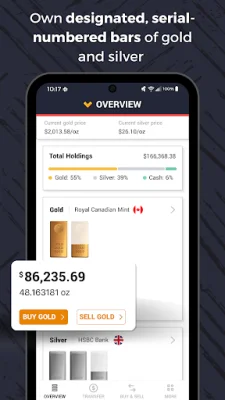

Vaulted is a unique application that allows users to diversify their investments and protect their wealth by holding their savings in gold and silver, the world's oldest and most trusted universal currency. The gold holdings are allocated to 99.99% pure gold kilo bars and stored at the Royal Canadian Mint, while the silver holdings are allocated to 99.9% pure silver 1,000 oz bars and stored in the vaults of HSBC Bank in London. This provides users with a secure and reliable way to invest in precious metals.

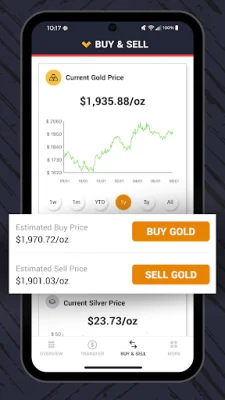

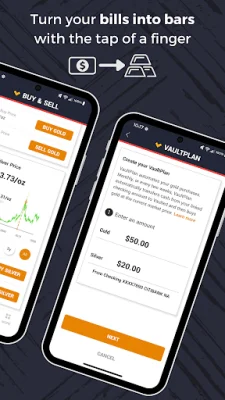

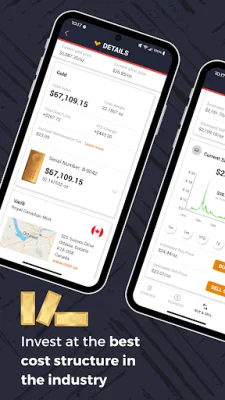

One of the key features that sets Vaulted apart is its cost-effectiveness. The application boasts tiny transaction costs, low maintenance fees, and stable bid-ask spreads, making it the most cost-effective way to acquire designated, serial-numbered ounces of gold and silver. This is made possible by cutting out 70% of the traditional precious metals supply chain, which not only reduces costs but also tightens the security of the network.

Another unique aspect of Vaulted is its personalized advising. Each user is assigned a personal precious metals advisor with over 15 years of experience managing precious metals portfolios. These advisors provide technical support, answer questions about the gold market, and determine optimal timing for purchases, ensuring that users make informed decisions about their investments.

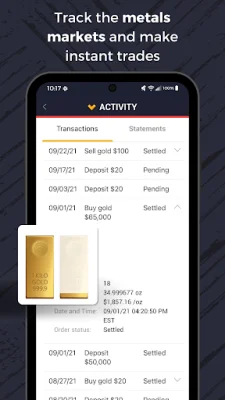

Transparency is also a key factor in Vaulted's approach. The current wholesale price and purchase/sale price are clearly listed on the app for every transaction, with a 0.8% premium on gold and a 2.0% premium on silver over the wholesale acquisition price. This eliminates any hidden fees and allows users to have a clear understanding of their investments.

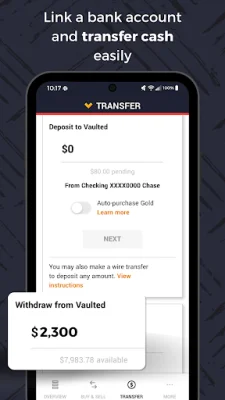

Convenience is another major benefit of using Vaulted. The mobile app makes it easy for users to secure their financial future by plugging them into the largest and most liquid precious metals markets in the world. Real-time visibility into investments is also provided, making it easier for users to track their progress.

Finally, Vaulted offers the option for physical delivery of precious metals to any address, unlike ETFs and futures contracts. Users can request delivery of their gold kilo bar from the Mint or smaller denominations of metal such as coins or 1-oz bars. This adds an extra layer of flexibility and control for users, allowing them to physically possess their investments if desired.

Rate the App

Popular Apps