Walmart MoneyCard®

2.3.0 by Green Dot (0 Reviews) November 26, 2025Latest Version

2.3.0

November 26, 2025

Green Dot

Finance

Android

0

Free

com.greendotcorp.walmart

Report a Problem

More About Walmart MoneyCard®

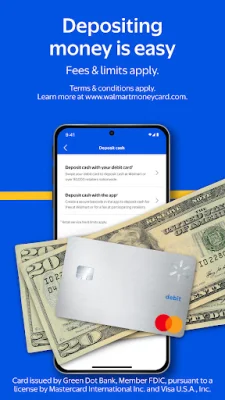

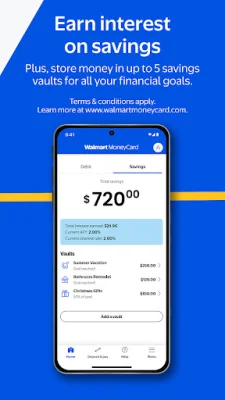

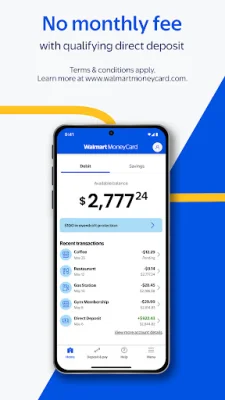

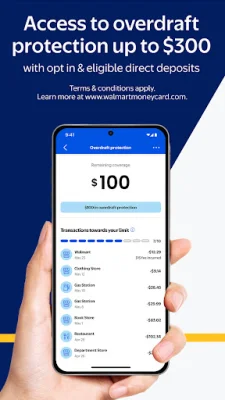

A Walmart MoneyCard is a prepaid debit card that offers a variety of benefits to its users. These benefits include early access to paychecks through direct deposit, cash back on purchases made at Walmart and Walmart.com, and the option for overdraft protection with eligible direct deposits and opt-in. There is no monthly fee for the card if the user has a qualifying direct deposit. Additionally, users can earn interest on their savings and store money in up to five savings vaults for different financial goals.

The Walmart MoneyCard can be used for purchases anywhere that accepts Debit MasterCard or Visa debit cards in the United States. There is no minimum balance or credit check required to obtain the card, making it accessible to a wide range of individuals. Depositing money onto the card is also easy, with options such as direct deposit, adding money from a linked bank account, cash reloads at Walmart stores, and depositing checks using a smartphone.

It is important to note that there may be fees and limits associated with certain features of the Walmart MoneyCard. Users should review the terms and conditions on the website for complete details. To activate the card, individuals must be of legal age in their state (18 or older) and go through an online identity verification process, including providing their Social Security Number. Mobile or email verification and access to the mobile app are also required to access all features of the card.

ATM access is only available with an activated and personalized card, and additional fees may apply. For more information, users can visit the Walmart MoneyCard website. It is also important to review the technology privacy statement, as Walmart is not a bank and the card is issued by Green Dot Bank, Member FDIC, under license from Visa and Mastercard.

Rate the App

Popular Apps