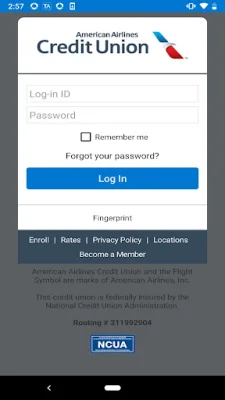

American Airlines Credit Union

5.9.10 by American Airlines Federal Credit Union (0 Reviews) October 30, 2024Latest Version

5.9.10

October 30, 2024

American Airlines Federal Credit Union

Finance

Android

0

Free

com.q2e.americanairlinesfederalcreditunion5083.mobile.production

Report a Problem

More About American Airlines Credit Union

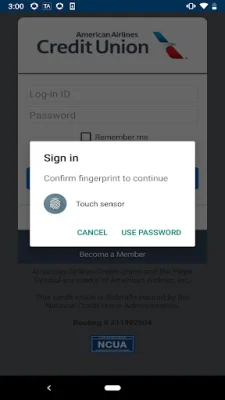

Card On/Off is a mobile application that allows users to easily manage their debit and credit cards. With this app, users can temporarily turn off misplaced cards, providing them with peace of mind and security. The app also offers a convenient and secure sign-in process using fingerprint recognition on supported Android devices. This allows for quick and easy access to the app and its features.

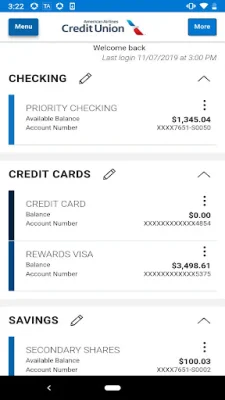

One of the main features of Card On/Off is the 360-degree view of the user's relationship with the Credit Union. This includes not only their own accounts, but also any joint accounts they may have. Users can also enroll in online statements, giving them access to electronic statements and notices. Additionally, the app offers the ability to monitor credit scores through SavvyMoney from any device.

Card On/Off provides a unified online banking experience, whether accessed through a computer, Android phone, or tablet. This allows for seamless navigation and use of the app's features. Users can also securely communicate with the Credit Union through the app, making it easy to send and receive messages about their account.

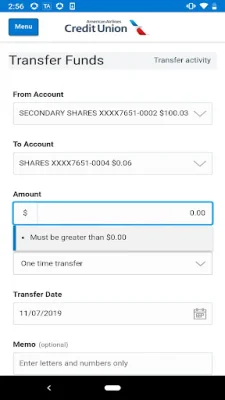

The app also offers a variety of convenient banking services, such as transferring funds, making loan payments, paying bills, and using Popmoney to pay other people. Users can also deposit checks through mobile deposit, making it easy to manage their finances on the go. Additionally, the app allows for setting up and transferring funds from accounts at other institutions.

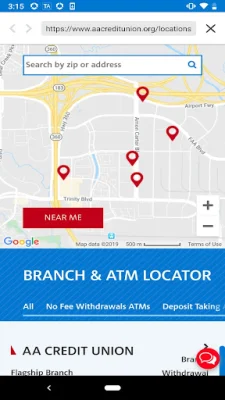

Other features of Card On/Off include the ability for new users to enroll directly from the app, access to budgeting and finance tools from any device, and the ability to apply for consumer loans and open secondary accounts. Users can also easily move account details from account tiles through a simple drag and drop feature. The app also provides a convenient way to locate surcharge-free ATMs, American Airlines Credit Union branches and ATMs, and CO-OP Shared Branch Network locations.

It's important to note that there may be fees associated with using the app, so users should check with their wireless carrier. All terms and conditions that apply to online banking also apply to the mobile services offered by Card On/Off. Additionally, any password changes must be completed or verified on a PC or laptop. Some features, such as mobile check deposit, may have eligibility requirements and deposit limits. The app also follows the Federal Reserve's standard requirements for financial institutions, limiting the number of transfers and withdrawals from savings accounts. Overall, Card On/Off offers a convenient and secure way for users to manage their debit and credit cards and access various banking services on the go.

Rate the App

Popular Apps