BBVA Trader CFD

1.2.5 by BBVA (0 Reviews) September 18, 2024Latest Version

1.2.5

September 18, 2024

BBVA

Finance

Android

0

Free

com.bbva.tradercfd

Report a Problem

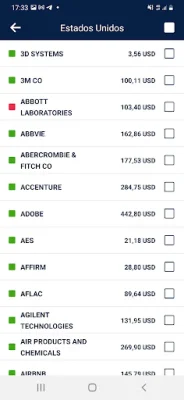

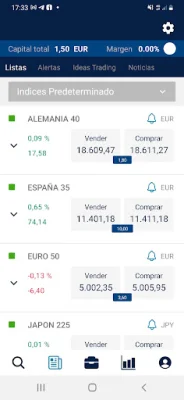

More About BBVA Trader CFD

CFD trading is a complex financial instrument that comes with a high risk of losing money quickly due to leverage. In fact, 76.54% of retail investors lose money when trading CFDs with this provider. It is important to understand how CFDs work and if you can afford to take on the high risk of losing your money.

CFD stands for "Contract for Difference" and it is a type of trading that allows investors to speculate on the price movements of various financial assets, such as stocks, currencies, and commodities, without actually owning the underlying asset. This means that you can potentially profit from both rising and falling markets, but it also comes with a higher level of risk.

One of the main reasons why CFDs are considered risky is because of the use of leverage. Leverage allows you to control a larger position with a smaller amount of capital, which can amplify your profits. However, it also amplifies your losses, and if the market moves against you, you could end up losing more than your initial investment.

It is important to note that CFD trading is not suitable for everyone. It requires a certain level of knowledge and experience in the financial markets, as well as a high tolerance for risk. Before deciding to trade CFDs, it is crucial to educate yourself on the risks involved and to carefully consider if it is the right investment strategy for you.

In summary, CFD trading is a complex and high-risk financial instrument that should not be taken lightly. It is important to fully understand how it works and to carefully assess your own risk tolerance before deciding to trade. Remember, 76.54% of retail investors lose money when trading CFDs, so it is crucial to approach it with caution and to only invest what you can afford to lose.

Rate the App

Popular Apps