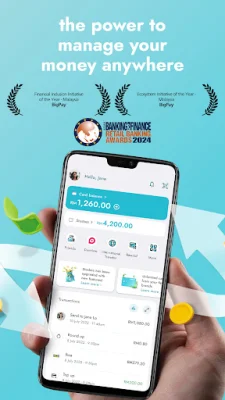

BigPay – financial services

3.1.2 by Big Pay (0 Reviews) October 13, 2024Latest Version

3.1.2

October 13, 2024

Big Pay

Finance

Android

0

Free

com.tpaay.bigpay

Report a Problem

More About BigPay – financial services

BigPay is an all-in-one financial app that offers a variety of benefits to its users. With simple and easy expense tracking, you can easily keep track of your spending right in the app. The app also offers Stashes, which allows you to save every time you spend. You can pay with a physical or virtual Visa card, as well as make DUITNOW QR payments in Malaysia, Singapore, Thailand, and Indonesia. Additionally, you can enjoy fast, secure, and affordable international remittance, seamless bill payments, and instant money transfers to friends on BigPay or other local banks via DuitNow.

Signing up for BigPay is quick and easy, taking only 5 minutes. Simply download the app, verify your identity, add money to your account, and you're all set!

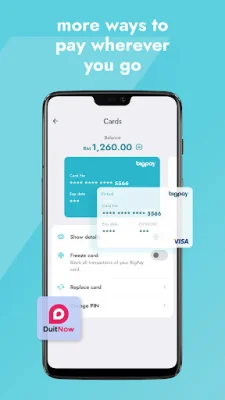

BigPay offers a variety of payment options, making it convenient for you to pay anywhere you go. With instant transfers via DuitNow QR and international transfers, you can spend in multiple countries. The app also offers physical and virtual Visa cards, giving you limitless spending and saving options across the globe.

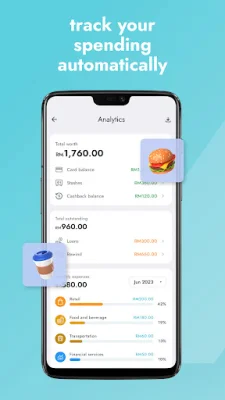

One of the standout features of BigPay is its automatic categorization of spending. This allows you to easily track your spending on a monthly and yearly basis and keep tabs on your budget. The app also offers fast, affordable, and secure international money transfers to friends and family, with competitive exchange rates and no hidden fees.

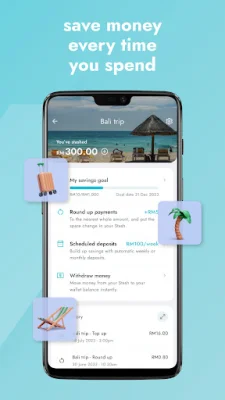

BigPay is your one-stop app for all your everyday payment needs. You can use it to pay your home utility bills, top up your mobile, and even purchase lifestyle insurance for peace of mind. The app also offers Stashes, which allows you to save a little or a lot whenever you spend. You can create multiple Stashes for different financial goals.

BigPay's mission is to empower you and your money. The app gives you the power to spend, track, and save, making it easy to manage your finances. And with the promise of continuously building new products and services, BigPay is dedicated to making managing your money as easy as possible. Additionally, users in Malaysia can borrow up to RM10,000 and pay it back in 6-12 months with a maximum interest rate of 18% per annum, with a fully digital loan process.

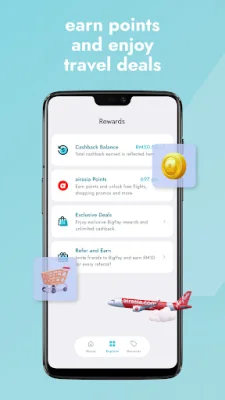

Lastly, BigPay offers rewards for every transaction you make, which can be turned into travel deals with airasia rewards. With its user-friendly interface and a wide range of features, BigPay is the ultimate financial app for anyone looking to take control of their finances.

Rate the App

Popular Apps