Bluebird

by Interactive Communications International, Inc. (0 Reviews) September 18, 2024Latest Version

September 18, 2024

Interactive Communications International, Inc.

Finance

Android

0

Free

com.bluebird.mobile

Report a Problem

More About Bluebird

Bluebird is a financial account that offers a convenient and flexible way to manage your money without any monthly fees. It aims to make your day-to-day financial tasks easier so you can focus on the things that matter most. You can visit Bluebird.com for more information about this service.

The Bluebird app allows you to easily manage your account on the go, no matter where you are. You can log in to check your Available Balance and view details of your active and completed transactions. This makes it easy to keep track of your finances and stay on top of your spending.

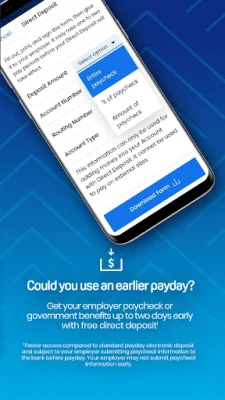

With Bluebird, you have various options for adding money to your account. You can add cash for free at Family Dollar stores, get your pay up to 2 days faster with free early direct deposit, or even add money from checks using your mobile device. This makes it convenient and hassle-free to add funds to your account.

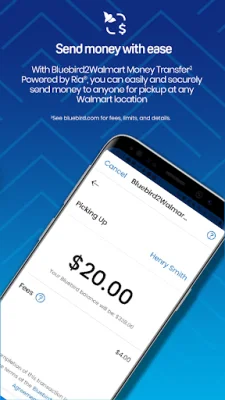

When it comes to spending your money, the Bluebird card can be used for purchases online or in-store. You can also withdraw cash for free at over 37,000 MoneyPass ATMs nationwide. Additionally, you can easily send money to other Bluebird accountholders, making it a convenient way to transfer funds to friends and family.

Bluebird is backed by trusted partners such as American Express, Family Dollar, and Visa, ensuring reliability and value for its users. The service also prioritizes the safety and security of your information and money, and offers 24/7 customer service support for any concerns or issues you may have.

While there may be fees for certain transactions, such as cash reloads at non-Family Dollar locations or using non-MoneyPass ATMs, Bluebird provides transparent information about these fees on their website. They also offer a mobile check capture service for easy check deposits, with fees and terms outlined on their website. Overall, Bluebird offers a convenient and reliable way to manage your finances without any monthly fees.

Rate the App

Popular Apps