Branch: A Better Payday

2024.9.1 by Branch Messenger (0 Reviews) September 13, 2024Latest Version

2024.9.1

September 13, 2024

Branch Messenger

Finance

Android

0

Free

com.branchmessenger

Report a Problem

More About Branch: A Better Payday

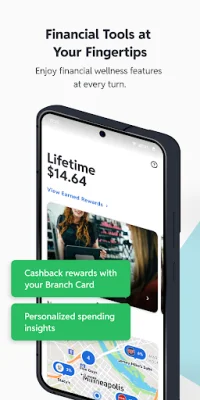

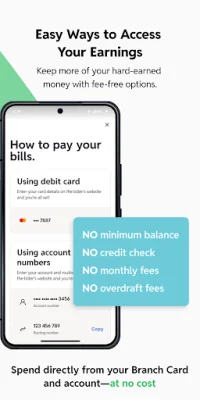

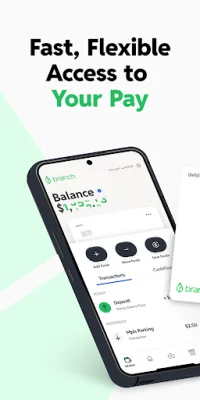

Branch is a financial application that allows you to manage your money in a variety of ways. With a Branch account and card, you can save, spend, or send your earnings however you choose. This gives you the flexibility to use your money in a way that best suits your needs and financial goals. One of the key features of Branch is the ability to save your money securely in a digital wallet. This wallet also includes a Savings Goal feature, which allows you to set aside funds for specific financial goals. This makes it easier to manage your money and work towards achieving your financial objectives. In addition to saving, Branch also allows you to send money to external bank accounts or to peers by connecting to other peer-to-peer (P2P) apps. This makes it convenient to transfer money to others when needed. You can also use your Branch Card to make purchases in-person or online, pay for gas and groceries, and withdraw cash for free at over 55,000 ATMs. This gives you the freedom to use your money as you please, without worrying about hidden fees or charges. Branch also offers a range of other useful features, such as fast and flexible access to your earnings, the ability to create your own payday by accessing up to 50% of your earned wages on-demand, and fee-free banking options. You can also access free financial wellness tools, earn cash back rewards, and easily pay bills and transfer money between bank accounts. Signing up for Branch is quick and easy, taking only 90 seconds or less. And if you need help, their responsive customer support team is available via phone or in-app chat. Branch is powered by Evolve Bank & Trust, a member of the FDIC, and the Branch Mastercard Debit Card is issued by Evolve Bank & Trust under a license from Mastercard. This means you can trust that your money is in safe hands when using Branch.

Rate the App

Popular Apps