bunq

26.1.1 by bunq (0 Reviews) October 14, 2024Latest Version

26.1.1

October 14, 2024

bunq

Finance

Android

0

Free

com.bunq.android

Report a Problem

More About bunq

Our Plans

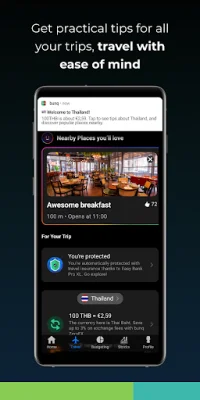

bunq offers a variety of plans to meet your banking needs. With Easy Card, you can get a free international credit card in just 5 minutes. This card can be used with Apple Pay or Google Pay and offers features such as auto-accepting payment requests and the ability to invest on the go. Plus, you have the chance to win great prizes through the Wheel of Fortune and access to a personal assistant named Finn. Finn also provides personalized budgeting tips and insights. Parents can also set up accounts for minors and use the Travel tab to find recommended places and receive travel tips. Additionally, for every €1,000 spent with your bunq card, a tree will be planted. With 24/7 online support, biometric ID, and deposit protection, you can feel secure using Easy Card.

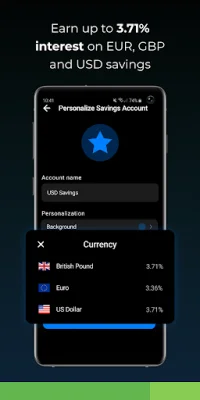

For those looking to save money, Easy Savings offers a free option with high interest rates and no fees. You can earn 2.16% base rate interest and 3.36% interest on funds exceeding your peak savings balance. Interest is paid weekly and you can make 2 withdrawals per month with no minimum deposit. You also have the freedom to choose where your money is invested and can add external bank accounts for a full overview of your finances.

For a small monthly fee of €3.99, Easy Bank provides a bank account in just 5 minutes. This includes 1 bank account, 1 joint account, and 1 joint savings account. You will also receive a physical debit or credit card and a free virtual credit card. With the metal credit card, you can pay in style wherever you go. You can also withdraw and deposit cash at participating stores, make instant payments, and schedule payments for bills and expenses. Additionally, you have access to shared accounts and can track your CO2 footprint.

For €9.99 per month (or free for students in the Netherlands receiving DUO on their bunq account), Easy Bank Pro offers a borderless bank account with easy budgeting. This includes all the benefits of Easy Bank, plus the ability to automatically pay from the right account or currency with AutoSelect. You also have 25 bank accounts, can open joint accounts with friends or housemates, and receive monthly spending breakdowns and comparisons. With Easy Investments, you can invest automatically and save up to 3% when paying abroad.

For even more benefits, Easy Bank Pro XL is available for €18.99 per month. This includes all the benefits of Easy Bank Pro, plus worldwide travel insurance, cashback on public transportation and restaurants, and the ability to earn more cashback with friends. You can also plant a tree for every €100 spent. All of these plans are also available for businesses.

At bunq, your security is a top priority. You can boost your bank security with two-factor authentication, Face and TouchID, and full control of your cards in the app. Additionally, your deposits are fully protected up to €100,000 by the DGS. You can also invest in the bunq app through partners, but please note that investing involves risks and bunq does not provide trading advice. bunq is authorized by the Dutch Central Bank and has a US office located in New York City.

Rate the App

Popular Apps