CBQ Mobile

by Commercial Bank of Qatar (0 Reviews) October 11, 2024Latest Version

October 11, 2024

Commercial Bank of Qatar

Finance

Android

0

Free

com.cbq.CBMobile

Report a Problem

More About CBQ Mobile

Commercial Bank Mobile Banking is a convenient and secure way for customers to access their bank accounts, loans, and credit cards. With 24/7 availability, users can easily check balances, pay bills, and transfer money between their own accounts and to local banks. The app also offers the flexibility to transfer funds internationally within 60 seconds and supports faster remittances to over 40 countries.

With Commercial Bank Mobile Banking, customers have access to their accounts anytime and anywhere through their mobile phones. The app is fully secure, using state-of-the-art security measures and complying with Qatar Central Bank's regulations. In the latest version, users can enter an international mobile number if they have trouble receiving SMS messages, providing added convenience.

The app also features the new CBsafe ID, which offers additional security to protect customers from fraudulent calls. This feature allows users to identify legitimate calls from the bank, ensuring caller authenticity and reducing the risk of fraudsters gaining access to personal information.

Commercial Bank Mobile Banking offers a wide range of features to make banking easier and more convenient for users. These include registering for fingerprint or face ID, viewing account balances and transactions, customizing the main dashboard, and personalizing account and card names. Users can also open additional accounts in various currencies, subscribe to e-statements, and enable voice activation.

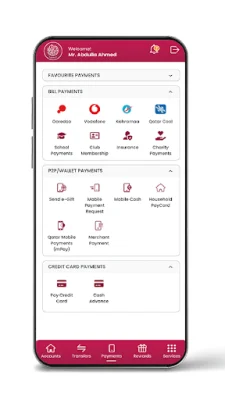

The app also offers a variety of payment options, including paying credit card bills, Ooredoo and Vodafone bills, and merchant bills. Users can also make charity payments, pay Kahramaa and Qatar Cool bills, and set up Apple Pay and CB Pay for tap and pay transactions. Other features include sending e-gifts, performing P2P and P2M payments, and converting credit card transactions to installments.

Commercial Bank Mobile Banking also offers convenient services such as cash advances from credit cards, sharing IBAN with family and friends, and managing transfer limits. Users can also redeem reward points, set up online travel plans, and locate CB card offers using augmented reality. The app even allows users to create a new PayCard account for their employees and add mobile numbers for add-on card holders. With all these features and more, Commercial Bank Mobile Banking makes banking easier and more accessible for customers.

Rate the App

Popular Apps