CU SoCal Mobile Banking

4013.2.0 by Credit Union of Southern California (0 Reviews) September 15, 2024Latest Version

4013.2.0

September 15, 2024

Credit Union of Southern California

Finance

Android

0

Free

com.socalcu.socalcu

Report a Problem

More About CU SoCal Mobile Banking

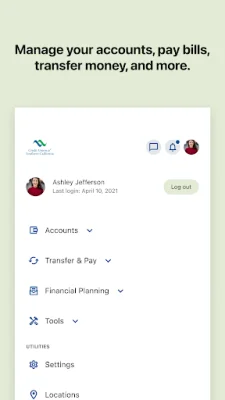

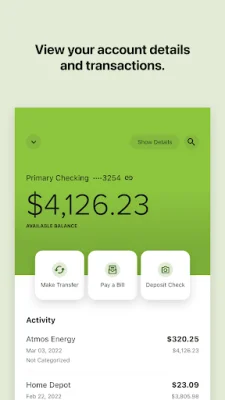

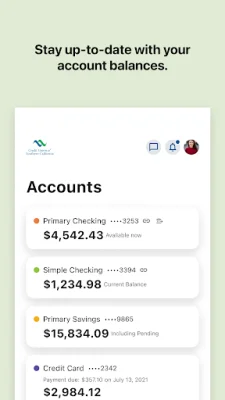

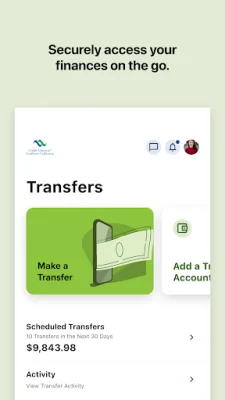

CU SoCal's mobile banking application offers a convenient and secure way for members to manage their finances. With this app, users can easily check their balances on various accounts such as checking, savings, certificates, loans, and credit cards. They can also view their transaction history, transfer money between accounts, deposit checks, pay bills, and manage their services.

One of the key features of this app is the ability to locate the nearest CU SoCal branch, CO-OP shared branch, or deposit-taking fee-free ATM. This makes it easier for members to access their funds and conduct transactions on the go. The app also prioritizes security, using highly secure encryption methods to protect all information transmitted through it. Additionally, a password or fingerprint authentication is required every time a user logs on to the app, ensuring that their personal and financial information remains safe.

CU SoCal is committed to providing a secure and user-friendly mobile banking experience for its members. The app is designed to make managing finances easier and more convenient, while also maintaining the highest level of security. Users can rest assured that their data is protected and their transactions are secure.

It is important to note that data and text charges may apply when using the mobile banking app, so users should check with their mobile provider. Additionally, eligibility requirements apply for using the app. CU SoCal is federally insured by NCUA, providing peace of mind to members knowing that their funds are protected.

In summary, CU SoCal's mobile banking app offers a range of features to help members manage their finances on the go. With its commitment to security and convenience, this app is a valuable tool for members to stay on top of their finances and access their funds whenever and wherever they need to.

Rate the App

Popular Apps