Debt Payoff Planner & Tracker

2.39 by Easily get a plan and stick to it - OxbowSoft LLC (0 Reviews) October 02, 2024Latest Version

2.39

October 02, 2024

Easily get a plan and stick to it - OxbowSoft LLC

Finance

Android

0

Free

com.oxbowsoft.debtplanner

Report a Problem

More About Debt Payoff Planner & Tracker

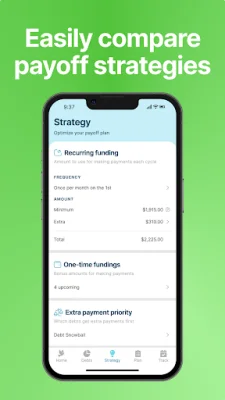

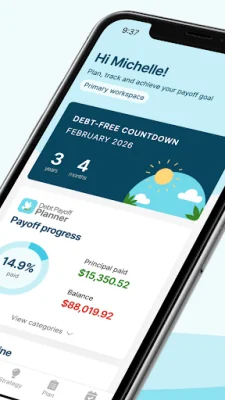

Debt Payoff Planner is an application that helps users become debt-free by providing a customized debt repayment schedule. This is done by entering basic information about loans, such as current balance, APR, and minimum payment amount. The app offers different strategies for paying off debt, including Dave Ramsey's Debt Snowball, Debt Avalanche, Debt Snowflake, and a custom plan.

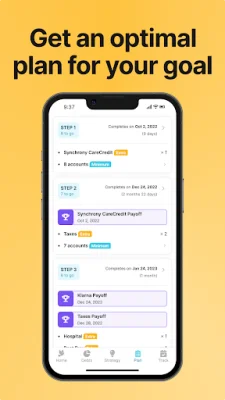

The first step to becoming debt-free with Debt Payoff Planner is to enter all loans and debts. Users can then input their additional monthly payment budget to pay off their debt faster. They can also choose from the different debt payoff strategies offered by the app. The recommended strategy is the Debt Snowball, as it focuses on paying off individual accounts faster to help users stay motivated and on track towards their goal.

The app also allows users to create an account for saving their debt payoff and payment information. This account can be accessed across multiple devices and app stores, providing a secure backup and easy access to information. The goal of the app is to make the process of becoming debt-free easier and more manageable for users.

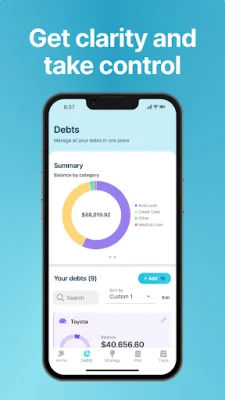

In addition to providing a debt tracker and loan calculator, Debt Payoff Planner also offers articles and tips on how to pay off different types of loans, such as student loans, auto loans, and credit cards. It also provides strategies for debt consolidation and balance transfers. The app supports eight different loan categories, including credit cards, student loans, auto loans, medical loans, mortgages, personal loans, taxes, and other types of loans.

Users can also customize their debt repayment plan and track their progress over time by inputting payment information into the app. This allows them to see their progress and stay focused on their financial goals. The app also supports one-time debt payments, known as Debt Snowflakes, which can come from sources like bonuses, tax refunds, or extra paydays.

Debt Payoff Planner aims to make the process of becoming debt-free easier and more manageable for users by providing an easy starting point and leveraging every dollar effectively. With minimal inputs and a user-friendly interface, the app makes money management and debt repayment more accessible for everyone.

Rate the App

Popular Apps