FIP (FUNDSINDIA PARTNER)

7.6.5 by FI Advisor Apps (0 Reviews) October 11, 2024Latest Version

7.6.5

October 11, 2024

FI Advisor Apps

Finance

Android

0

Free

com.fiadvisor

Report a Problem

More About FIP (FUNDSINDIA PARTNER)

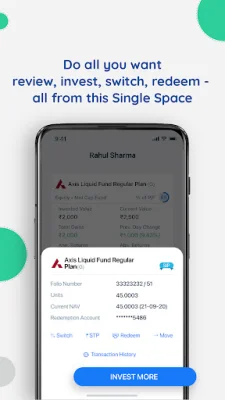

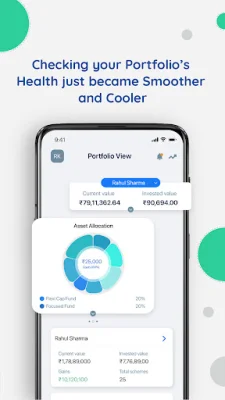

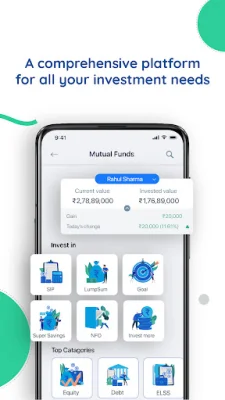

The FIP app allows users to easily invest in India's top mutual funds. With just a few clicks, users can sign in and start investing in a variety of fund categories, including equity funds, income funds, and ETFs. Transactions can be confirmed by an Authorized FundIndiaPartner, and users can schedule appointments with them for personalized investment advice. The app also provides 24x7 access to investment portfolios and allows users to monitor and track fund performance.

One of the key features of the FIP app is the ability to start a Systematic Investment Plan (SIP) to help users build wealth over time. Users can sign up and start investing through KYC verification, and even consult with FundsIndia financial Investment Coaches to determine their financial goals and needs. SIP investments can be made with as little as ₹1000 per month.

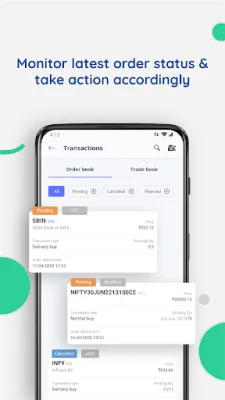

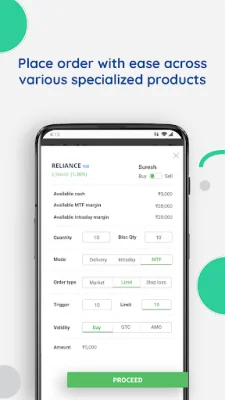

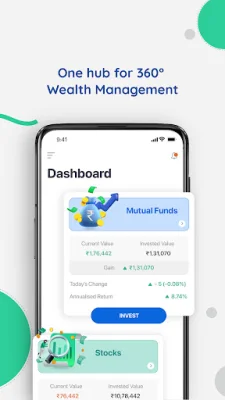

The FIP app is a one-stop shop for all investment needs, offering a unified platform for both mutual fund and stock investments. Users can easily monitor and manage all their investments in one convenient dashboard, and receive real-time alerts and recommendations for NAV and stocks. The app also allows for easy redemption of investments.

For those looking to save on taxes, the FIP app offers ELSS Funds (Equity Linked Savings Schemes) which can save up to Rs 46,800 TDS from taxable income under Section 80C. These tax-saving funds have a lock-in period of 3 years and offer higher returns and more flexibility than traditional options like FDs and PPFs.

The FIP app takes security seriously, with bank-level security measures in place to protect user data. All passwords are encrypted and stored securely, and all communications are 256-bit encrypted. The app is hosted by top-tier hosting service providers and is registered with SEBI and approved by exchanges like NSE and BSE for various segments like CM, FO, and CD.

Rate the App

Popular Apps