Firstcard: Credit Builder Card

2.3.24 by Firstcard, Inc (0 Reviews) October 22, 2024Latest Version

2.3.24

October 22, 2024

Firstcard, Inc

Finance

Android

0

Free

com.firstcard.firstcard

Report a Problem

More About Firstcard: Credit Builder Card

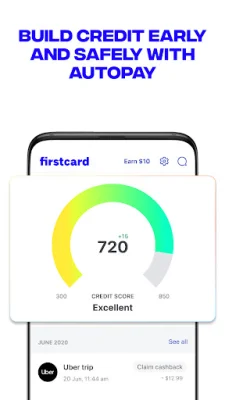

Firstcard is a financial technology company that offers a unique credit card designed to help individuals build their credit score early and safely. This credit card allows users to earn cashback every time they spend, making it a great option for those looking to improve their credit while also earning rewards. What sets Firstcard apart is its inclusive approach, accepting immigrants, international students, foreigners, and non-US citizens without an SSN¹. This means that anyone with a passport can apply for the card, regardless of their citizenship status.

One of the most appealing features of Firstcard is that there is no credit check or hard inquiry required for approval. This means that even those with no credit history or a low credit score can still be approved for the card. Additionally, there are no fees associated with the card, including interest, annual fees, overdraft fees, late payment fees, or account minimum requirements. This makes it a great option for those who want to avoid overspending and unnecessary fees.

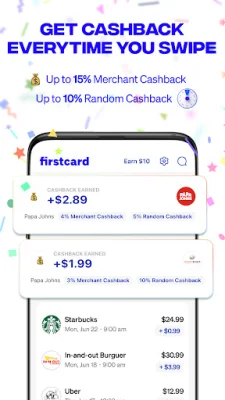

In addition to helping users build their credit, Firstcard also offers the opportunity to earn cashback on purchases. Users can earn up to 15% Merchant Cashback at 29,000 partner merchants, as well as up to 10% Random Cashback on all qualifying purchases. For Firstcard+ members, there is an additional 1% cashback on all qualifying purchases. This means that users can earn rewards while also working towards improving their credit score.

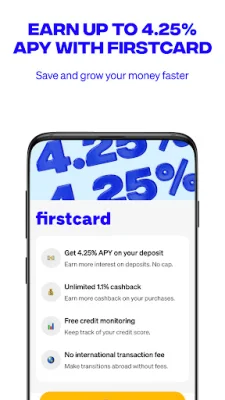

Firstcard also offers the opportunity to grow your money over time through its deposit account. All members can earn 1.25% Annual Percentage Yield⁴ (APY), while Firstcard+ members can enjoy 4.25% APY. This is significantly higher than the national average interest rate on savings accounts, which is currently at 0.45% APY⁵. This makes Firstcard a great option for those looking to save and earn interest on their money.

At Firstcard, equal access is a top priority. As mentioned, the card is available to immigrants, international students, foreigners, and non-US citizens without an SSN¹. Additionally, those with no credit score or a low credit score can still be approved for the card. This inclusive approach allows everyone to have the opportunity to build their credit and improve their financial standing.

When it comes to security and support, Firstcard has you covered. Your money is FDIC-insured up to $250,000 through Regent Bank, member FDIC. The Firstcard credit card is also issued pursuant to a license from Mastercard® International Inc. This means that users can trust in the security and reliability of their card. Additionally, Firstcard's team is based in the US and the company is headquartered in Silicon Valley, providing users with accessible and reliable customer support.

In summary, Firstcard is a unique credit card that offers individuals the opportunity to build their credit score, earn cashback, and grow their money over time. With its inclusive approach and no fees, it is a great option for those looking to improve their financial standing. Plus, with its high interest rates and FDIC-insured accounts, users can trust in the security and reliability of Firstcard.

Rate the App

Popular Apps