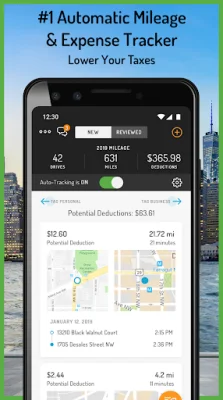

Hurdlr: Mileage, Expense & Tax

40.7.1 by Hurdlr, Inc. (0 Reviews) October 06, 2024Latest Version

40.7.1

October 06, 2024

Hurdlr, Inc.

Finance

Android

0

Free

app.hurdlr.com

Report a Problem

More About Hurdlr: Mileage, Expense & Tax

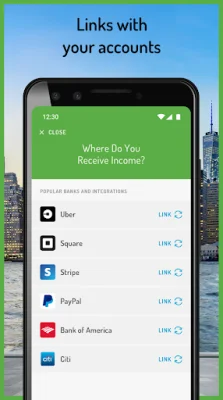

Hurdlr is an application that helps self-employed individuals and small business owners manage their finances and taxes. It connects with various banks and popular platforms like Uber, FreshBooks, and Paypal to automatically import income and expenses, making it easier to calculate income taxes. With Hurdlr, users can say goodbye to the hassle of keeping track of receipts and mileage logs in a shoebox.

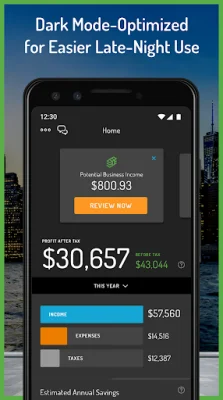

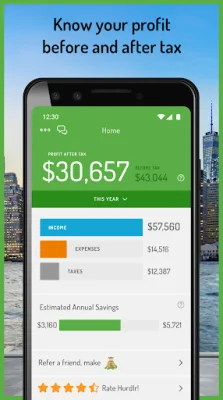

The app offers a free version that includes not only mileage tracking but also expense and income tax tracking. For more advanced features, users can upgrade to the premium version, which is more affordable than other self-employed accounting apps. Hurdlr also has a detailed business tax tracker specifically designed for 2020 quarterly tax accounting.

Hurdlr is perfect for 1099 workers, including independent contractors, freelancers, small business owners, and self-employed entrepreneurs. It is also useful for individuals working for companies like Uber, Lyft, Postmates, and Airbnb. The app's automatic mileage tracker helps users claim maximum tax deductions, making it ideal for those who are constantly on the go.

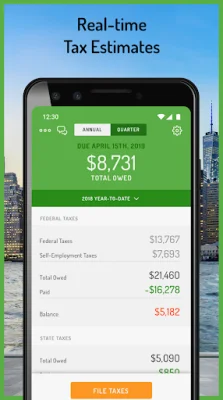

In addition to mileage tracking, Hurdlr also offers automatic expense tracking and identifies valuable tax deductions for independent contractors and small business owners. Users can export detailed expense reports with receipts and send them to their email or tax preparer. The app also provides real-time year-end and quarterly tax estimates, helping users save thousands of dollars in taxes.

Hurdlr also has an income tracker that connects with various platforms and banks to notify users when they get paid. This feature is especially useful for individuals working for multiple companies or platforms. The app is optimized for low battery usage, making it ideal for those who are always on the road.

The team behind Hurdlr is made up of experienced entrepreneurs who have worked closely with users to create an app that meets their needs. The app also offers excellent customer support, with the option to talk to a representative directly from within the app. Users can also contact the team through email, Facebook, or the Hurdlr website.

Hurdlr offers a premium version for $9.99 a month or $99.99 a year, which includes features like auto-mileage tracking, auto-expense tracking, and real-time tax calculations. The app also offers a bonus feature where the premium version can be deducted as a business expense when filing taxes. Users can learn more about the app's privacy policy and terms of use on the Hurdlr website.

Rate the App

Popular Apps