iCash–Transaction Banking

1.0.75 by Bangkok Bank PCL (0 Reviews) October 11, 2024Latest Version

1.0.75

October 11, 2024

Bangkok Bank PCL

Finance

Android

0

Free

com.bangkokbank.cashdigiitcp

Report a Problem

More About iCash–Transaction Banking

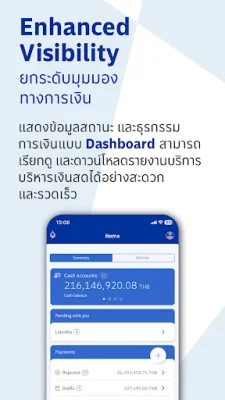

The Account Services application provides users with detailed information about their financial positions, including cash, loans, investments, and credit facilities. This includes both domestic and foreign accounts with Bangkok Bank. Users can also access information about foreign exchange rates and special offers, as well as set up forward contracts with the bank.

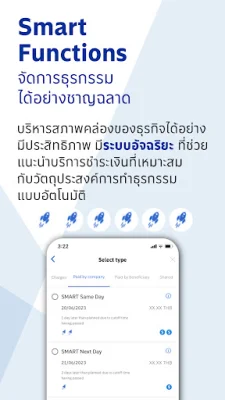

The Payment Services feature allows users to make a variety of electronic payments, such as transfers between Bangkok Bank accounts, payroll payments, and direct credits to business counterparts. Users can also make domestic fund transfers to other banks and use the PromptPay service. For international transactions, users can make outward fund transfers. The Smart Payment Advisory Services feature helps users determine the best transaction option for their specific needs. Customers can also manage their own payments by setting up stop or hold instructions, and can access additional services such as transaction advice and beneficiary validation.

The Liquidity Management feature provides users with reports on their cash aggregation, intercompany lending, and cash investment activities. This includes intraday and end of day sweeping, as well as a summary report of linked accounts. The Alerts and Reports feature allows users to set up transaction alerts for approvers, ensuring that all transactions are properly authorized.

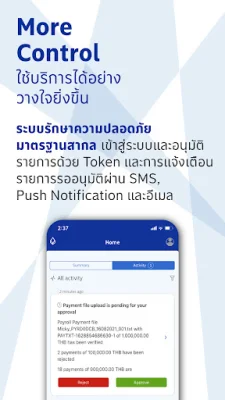

Security is a top priority for the application, with features such as digital token and advanced biometric authentication to ensure the safety of user information and transactions. Customers can also manage their own accounts through the Customer Self-administration feature, which includes user login and preference management.

For more information about the application and its features, customers can contact the Corporate Service Center during business hours. The application is designed to provide users with comprehensive financial management tools and services, making it easier for them to manage their accounts and transactions efficiently and securely.

Rate the App

Popular Apps