IndusInd Bank: Savings A/C, FD

2.0.3 by IndusInd Bank Ltd. (0 Reviews) October 30, 2025Latest Version

2.0.3

October 30, 2025

IndusInd Bank Ltd.

Finance

Android

0

Free

com.indusind.indie

Report a Problem

More About IndusInd Bank: Savings A/C, FD

IndusInd Bank offers a convenient and hassle-free way to open a savings account with their 100% digital process. With this account, customers can access premium features such as scan-and-pay, bill payments, and zero-fee transactions. The best part? There are no non-maintenance charges for maintaining a zero balance account. Plus, customers can do everything from booking a fixed deposit to applying for a loan or credit card, or even investing in mutual funds, all from one app.

Opening a savings account with IndusInd Bank is quick and easy, with no paperwork required. Customers can choose from a variety of account options, including a zero balance account, and enjoy exclusive features such as high interest rates of up to 5% p.a., free NEFT/RTGS transactions, and unlimited ATM cash withdrawals at IndusInd Bank ATMs. Customers can also earn rewards on their preferred brands, UPI transactions, and fuel purchases, and enjoy perks like 0 forex mark-up and complimentary airport lounge access.

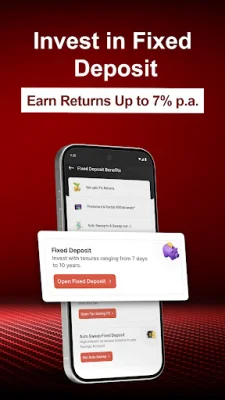

IndusInd Bank also offers the convenience of booking a fixed deposit from the comfort of your own home through their mobile banking app. Customers can enjoy high interest rates of up to 7% p.a. and choose from regular, tax-saving, or senior citizen FD options. The auto-sweep feature allows for dual benefits of liquidity and high returns, and customers can link their fixed deposit to their savings account for easy payment options.

In need of some extra cash? IndusInd Bank has got you covered with their instant personal loan and line of credit options. Customers can apply for a loan of up to ₹5 lakh with a 100% digital application process and enjoy discounted processing fees, flexible tenure options, and low interest rates. The mobile banking app also offers the convenience of an instant line of credit, with the ability to withdraw money multiple times and pay interest only on the withdrawn amount.

Managing credit cards has never been easier with IndusInd Bank's mobile banking app. Customers can apply for a credit card with a paperless process and instant approval, and then manage their card through the app. Features include setting/resetting pin and transaction limits, accessing instant statements and tracking spends in real time, paying bills securely and conveniently, and keeping track of reward points.

The app also offers the convenience of managing and paying all utility bills, including electricity, gas, and water, in one place. Customers can also top-up their mobile, DTH, and data card securely and automate bill payments to avoid late fees. For those looking to diversify their investment portfolio, the app offers a range of mutual fund options to choose from. Customers can start their SIP investment from as low as ₹500, buy, sell, and manage funds with just a few clicks, and get personalized fund options based on their risk appetite.

Lastly, IndusInd Bank's mobile banking app allows for safe and quick online fund transfers through various methods such as UPI, IMPS, NEFT, and RTGS. Customers can transfer funds instantly without adding a beneficiary, easily manage beneficiaries, and automate recurring payments. And for any queries or assistance, the customer support team is just a call or email away. With IndusInd Bank's mobile banking app, managing finances has never been easier.

Rate the App

Popular Apps