MySIPonline: SIP & Mutual Fund

12.10.1 by MY SIP ONLINE (0 Reviews) November 08, 2025Latest Version

12.10.1

November 08, 2025

MY SIP ONLINE

Finance

Android

0

Free

com.mysiponline

Report a Problem

More About MySIPonline: SIP & Mutual Fund

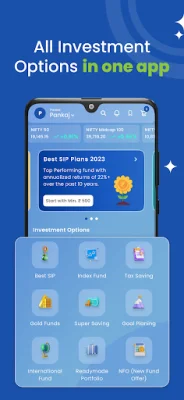

MySIPonline is a mutual fund and SIP investment app in India that offers a variety of features to make investing easier and more convenient for users. The app has a simple and elegant design, making it perfect for beginner investors. It also offers a video KYC process that takes only 5 minutes, allowing users to start, stop, pause, or increase their SIP online at any time. Additionally, users can raise queries through tickets at the support desk, which is available at all times. The app also has no hidden charges, making it a transparent and trustworthy option for investors.

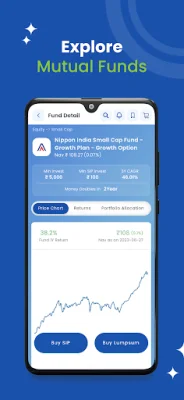

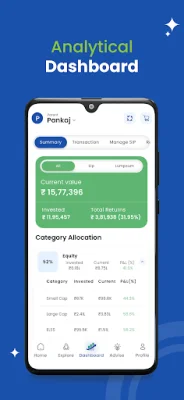

The technical features of MySIPonline include a dashboard facility that allows users to keep track of all their investments in one place. It also has a detailed order book and SIP book with pause options, as well as regular news and market updates. Users can also track and compare different schemes, with over 3000 schemes available on the app.

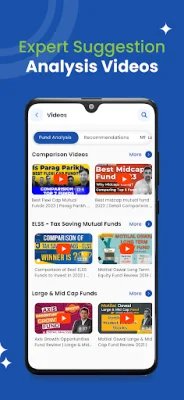

The app also offers fund recommendations based on individual requirements, age, goals, and risk. It has a regularly updated list of top performing and recommended mutual funds, and users can also seek expert assistance on any working day. For advanced recommendations, the app also has an AI mechanism.

MySIPonline also offers a range of financial calculators, including SIP, SIP plan, SIP top-up, mutual fund returns, and lumpsum calculators. It also has complete financial planning options for retirement, post-retirement income, child's future, education fund, and marriage planning. Additionally, the app has ELSS and tax saver funds, as well as a mutual fund basket with different portfolios.

The app also offers other products such as gold funds, index funds, smart saving or emergency funds, international funds, and NFOs. It also has advanced security features, including bank-level security on the payment gateway, encrypted data transfer, and 2FA for transactions.

MySIPonline is officially registered with AMFI under ARN number 106881 and has a wide range of schemes from top AMCs such as Kotak, Aditya Birla Sunlife, ICICI Prudential, HDFC, SBI, and more. The app has been used by thousands of successful investors and is a trusted and reliable option for mutual fund investments.

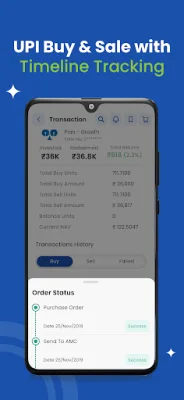

To start investing through MySIPonline, users can download the app, validate their profile through quick video KYC, explore and select the best fund, add it to their cart, verify the transaction with OTP, make the payment, and track the order's timeline. With the app's dashboard, users can watch their small investments grow into superior wealth.

Rate the App

Popular Apps