NatWest ClearSpend

5.3.05 by National Westminster Bank PLC (0 Reviews) October 13, 2024Latest Version

5.3.05

October 13, 2024

National Westminster Bank PLC

Finance

Android

0

Free

com.natwest.clearspend

Report a Problem

More About NatWest ClearSpend

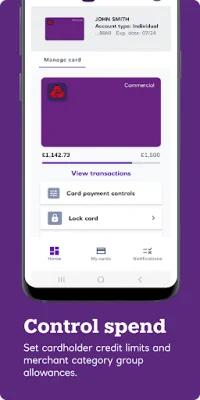

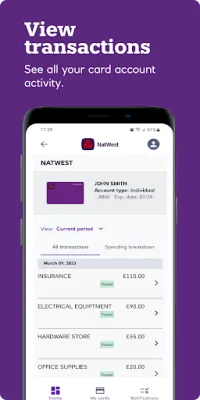

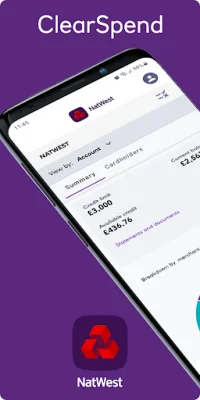

NatWest ClearSpend is a mobile application that provides real-time balance information and allows users to view their transactions, including pending and declined ones. It also allows users to view regular statements and set credit limits for cardholders. Additionally, users can set merchant category blockings and lock or unlock an employee's card through the app.

One of the key features of NatWest ClearSpend is the ability to receive transaction notifications, keeping users informed about their spending in real-time. This can help users stay on top of their finances and avoid any surprises when it comes to their account balance.

The app also allows users to approve online purchases, providing an extra layer of security for cardholders. This feature can help prevent fraudulent transactions and give users peace of mind when making online purchases.

NatWest ClearSpend also offers the option to create departments, allowing businesses to segregate their spending and track expenses more efficiently. This can be especially useful for larger organizations with multiple departments and budgets to manage.

The app is designed for both administrators and cardholders, making it a convenient tool for businesses of all sizes. To get started, users simply need to download the app and follow the onscreen instructions to register. Please note that the Business or Commercial Card account must be registered and activated before cardholder users can register.

NatWest ClearSpend is available to eligible NatWest Business and Commercial Card account customers with compatible Android devices and a UK or international mobile number in specific countries. It is only available to users over 18 years old and is subject to other terms and conditions. With its user-friendly interface and helpful features, NatWest ClearSpend is a valuable tool for businesses looking to manage their expenses and stay on top of their finances.

Rate the App

Popular Apps