NB|AZ Mobile Banking

8.0.26 by Zions Bancorporation, N.A. (0 Reviews) October 31, 2025Latest Version

8.0.26

October 31, 2025

Zions Bancorporation, N.A.

Finance

Android

0

Free

com.mfoundry.mb.android.mb_nba_pb

Report a Problem

More About NB|AZ Mobile Banking

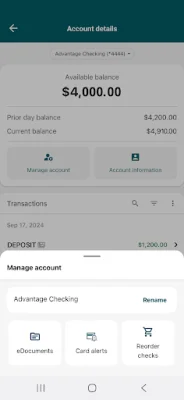

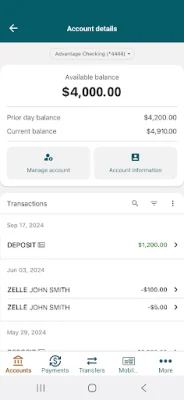

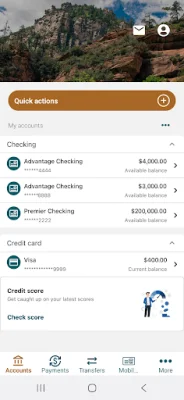

The Personal Banking features of this application allow users to easily manage their accounts and finances. Users can view their account balances, details, and activity across all of their accounts. They can also access their personal credit score and report for free, apply for new accounts, and review statements and notices. The app also offers the option to export transactions for easy record-keeping.

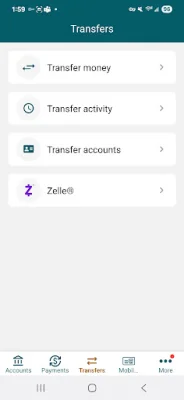

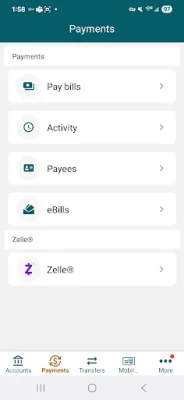

The Payments & Transfers feature allows users to send and receive money with Zelle®, transfer funds, pay bills, and send wires. They can also conveniently deposit checks using their mobile device. The app also offers security and card controls, such as using biometrics for sign-in and instantly locking or unlocking cards. Users can also set up and manage security alerts for added protection.

The Rewards & Offers feature allows users to view their credit card rewards and discover personalized offers. The app also offers self-service options, such as finding a branch or ATM, scheduling travel notifications, and more.

The Business Banking features of this app offer even more convenient and efficient ways to manage finances. Users can pay bills and employees, send and receive wire transfers, and use Zelle® for business payments. They can also create and send invoices, share payment links and QR codes, and accept various forms of payment, including cards, ACH, and Apple Pay.

The app also offers user management capabilities, allowing businesses to manage users and permissions, reset passwords and access, and receive personalized activity alerts. Additionally, businesses can use the Invoice & Get Paid feature to easily create and send invoices, share payment links and QR codes, and accept various forms of payment.

The app prioritizes security and authorization, offering biometric sign-in, multi-factor authentication, and the ability to enable dual authorization for added protection. To use the app, users must have an account with National Bank of Arizona, a compatible mobile device, and a U.S. phone number. Message and data rates may apply. For any questions or concerns, users can contact Mobile Banking Customer Support.

Rate the App

Popular Apps