NBE Mobile

1.0.47 by National Bank of Egypt (0 Reviews) November 08, 2025Latest Version

1.0.47

November 08, 2025

National Bank of Egypt

Finance

Android

0

Free

com.ofss.obdx.and.nbe.com.eg

Report a Problem

More About NBE Mobile

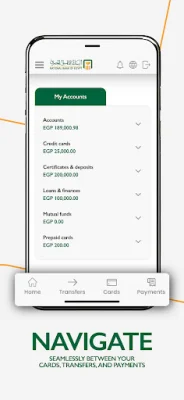

The "NBE Mobile" service is a convenient and secure way for individuals and corporate clients to access advanced banking services from their mobile devices. With this service, users can perform a variety of banking tasks anytime and anywhere, making it easier to manage their finances on the go.

One of the main features of the "NBE Mobile" service is the ability to instantly review all types of accounts, including investment certificates, savings certificates, mutual funds, prepaid cards, and credit cards. This allows users to stay updated on their account balances and transactions without having to visit a physical bank branch.

Another useful feature is the ability to transfer funds between different accounts within the bank. This makes it easier for users to manage their finances and move money between their various accounts as needed.

In addition to internal transfers, the "NBE Mobile" service also allows users to transfer funds to other accounts within the bank or with other banks in local currency. This can be done using a soft or hard token for added security.

The service also offers the convenience of making credit card payments directly from the mobile app. Users can easily view their credit card statements and make payments without having to visit a bank branch or use a separate payment platform.

For those looking to invest or save money, the "NBE Mobile" service allows users to purchase or redeem investment certificates, savings certificates, mutual funds, and time deposits. This can all be done conveniently through the app, making it easier for users to manage their investments.

In addition to banking services, the "NBE Mobile" app also offers access to Fawry's payment services. This allows users to make payments for various services and bills, further adding to the convenience of the app.

Users can also apply for credit cards and loans through the app, making it easier to access credit and manage their finances. The app also offers the option to request an Iscore, which can help users understand their creditworthiness and make informed financial decisions.

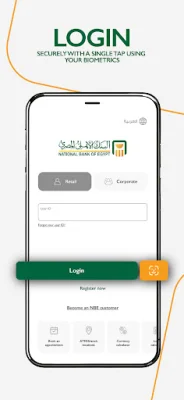

To ensure the security of transactions, the "NBE Mobile" app allows users to authenticate their transactions using a soft token. This adds an extra layer of protection to prevent unauthorized access to accounts.

For easy and quick access to the app, users can also log in using Touch ID or Face ID, providing a seamless and secure login experience. With its range of features and convenience, the "NBE Mobile" service is a valuable tool for managing finances on the go.

Rate the App

Popular Apps