Panhandle First: Learn & Earn

3.31.16 by BusyKid (0 Reviews) October 10, 2024Latest Version

3.31.16

October 10, 2024

BusyKid

Finance

Android

0

Free

com.busykid.panhandlefirstbank

Report a Problem

More About Panhandle First: Learn & Earn

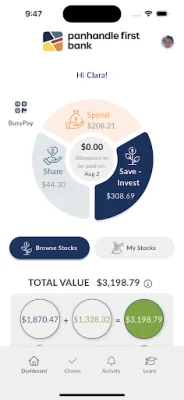

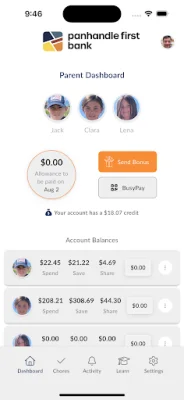

Our app is designed to help kids and teens learn important money management skills that will prepare them for success as adults. It allows them to make real-life money decisions from the convenience of their phone, with parents acting as a safety net. The app has three main areas: Save/Invest, Share, and Spend, where kids can earn money, manage it, and even transfer it to their own prepaid card for purchases. All money transactions must be approved by parents, giving them control and oversight.

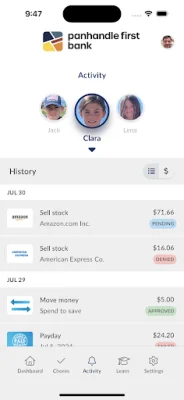

One of the key features of our app is the chores and allowance tracker. Parents can assign chores to their kids based on their age and schedule, and the app helps kids learn how to earn money and develop important character traits like accountability, dependability, time management, and teamwork. The app also offers real-time push notifications for chores and money transactions, making it easy for parents to stay on top of their child's progress.

Our app also teaches kids about investing from an early age, with the potential for limitless growth. Parents can use the app to teach their kids the basics of investing, with just a few clicks to select popular stocks and ETFs. The app's integrated investing platform, backed by Apex Clearing Corporation, makes it simple and safe to invest. And with transactions starting at just $10 and no commissions, parents can empower their child's financial growth without breaking the bank.

BusyPay is another convenient feature of our app, allowing friends and family to add money to a child's account for special occasions or for completing tasks for neighbors. Kids can also use BusyPay to send money to others using BusyKid. And for those who want to give back, the app offers the option to donate a portion of their allowance to over 60 charities.

Safety is a top priority for us, which is why we use the latest SSL encryption technology and ensure that all funds in the app are FDIC insured. Each child's account and card requires a unique PIN for added security, and we strongly encourage parents to use different PINs for each child. Parents also receive alerts for any money transactions or card issues, and all sensitive information is stored by partners who are compliant with Payment Card Industry Data Security Standards.

It's important to note that our Visa® Prepaid Card is issued by Pathward®, N.A., Member FDIC, and our brokerage services are provided by Apex Clearing, an SEC-registered broker-dealer and member of FINRA/SIPC. Investing in securities involves risks, and there is always the potential to lose money. Before investing, it's important to consider your investment objectives, charges, and expenses. Our app is a valuable tool for teaching kids and teens about financial responsibility and preparing them for a successful future.

Rate the App

Popular Apps