Rocco - Fast Cash Advance

1.0.41 by Rocco Finance, Inc. (0 Reviews) September 14, 2024Latest Version

1.0.41

September 14, 2024

Rocco Finance, Inc.

Finance

Android

0

Free

com.rocco

Report a Problem

More About Rocco - Fast Cash Advance

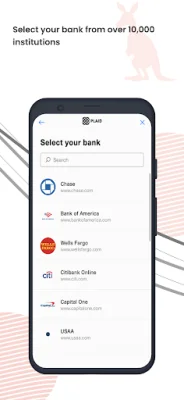

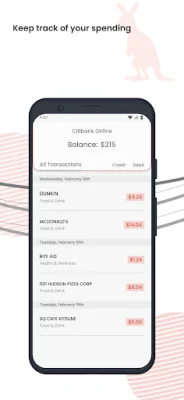

Rocco is a personal finance app that allows users to access their earned wages early in order to cover expenses and avoid overdraft fees. Through the mobile app, users can view their bank account balance, receive overdraft alerts, and gain insights into their spending habits. The app also offers the option to request between $10-$100 from their earnings without any fees, although eligibility criteria does apply.

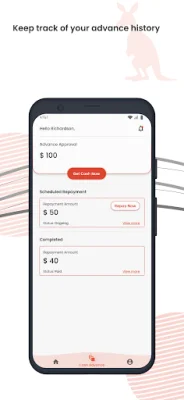

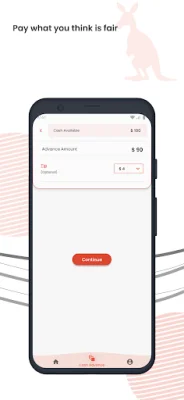

In order to get started with Rocco, users simply need to add their bank account and verify that they are actively receiving paychecks. Once confirmed, they can request cash from their earnings and pay what they think is fair. For example, if they cash out $100, their future repayment will also be $100. It's important to note that Rocco has no legal right to repayment, making it different from a payday loan or personal loan.

Rocco prides itself on being a transparent and ethical option for accessing earned wages. There is no interest or APR charged for cashing out from a paycheck, and the app does not sell personal data to third parties. Users can learn more about the app's privacy policy on their website.

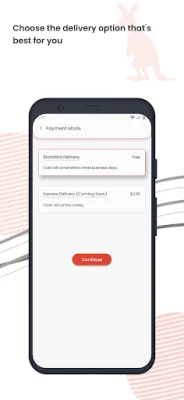

One of the unique features of Rocco is that there is no mandatory minimum or maximum repayment term, and the app does not charge late payment fees. Repayment is typically scheduled for the user's next predicted direct deposit date, but can also be made manually within the app at any time. If a user chooses to take a $100 advance with an optional $7.99 service fee and adds a $5 tip, their total settlement will be $112.99.

While not all users will qualify for early access to their earned wages, Rocco offers the option to add an optional tip when requesting an advance. For those who need the funds immediately, there is an express transfer option for a small fee. Express advances are typically delivered within 20 minutes. If users have any questions or concerns, they can contact Rocco's customer service team by emailing [email protected].

Rate the App

Popular Apps