SC Mobile Nigeria

by Standard Chartered Bank PLC (0 Reviews) October 31, 2025Latest Version

October 31, 2025

Standard Chartered Bank PLC

Finance

Android

0

Free

com.sc.breezenigeria.banking

Report a Problem

More About SC Mobile Nigeria

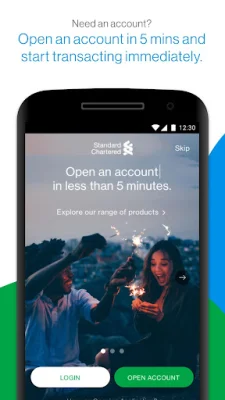

Experience the ultimate convenience of digital banking with Standard Chartered Bank's mobile app. Say goodbye to long queues and hello to a seamless banking experience right at your fingertips. Download the app now and open a Standard Chartered Bank account instantly, without any hassle or wait time.

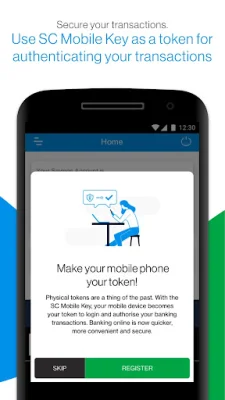

With SC Mobile, you can enjoy a wide range of banking services, including fund transfers, account management, and other essential transactions. No need to visit a physical branch, as you can do all your banking needs anytime and anywhere through your mobile phone. Be unstoppable and take control of your finances with SC Mobile.

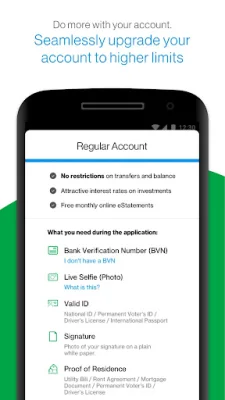

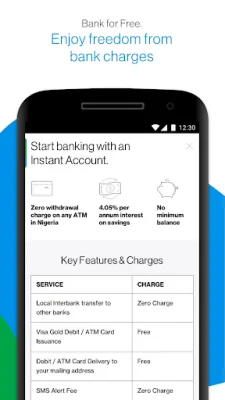

In just 5 minutes, you can open an Instant Account with Standard Chartered Bank and enjoy all the benefits of banking with a world-class financial institution. And if you want to do more transactions, you can easily upgrade your account to Instant Plus, Salary, or Regular Savings. You can even open a Current Account in Naira, USD, or GBP, with the option to apply for mortgages, personal loans, and credit cards coming soon.

One of the best things about banking with SC Mobile is that it comes at no cost. You won't be charged for inter-bank local transfers, SMS transactions, and even your first Gold Visa Debit/ATM card. Plus, you can enjoy zero cash withdrawal fees on any 3rd party ATM in Nigeria, regardless of the number of withdrawals. Grow your wealth with high-interest savings, fixed deposits, and investments in Treasury Bills, Bonds, and Mutual Funds.

Take control of your finances and be your own banker with SC Mobile. You can easily request for a new card, block or replace it, activate your debit/credit card, and even reset your PIN, all from the app. You can also book fixed deposits, order for a cheque book, and make requests for account statements and reference letters. With SC Mobile, you have a complete view of your accounts and can transact with ease, whether it's transferring funds, topping up airtime, subscribing to data bundles, or paying bills. Download the app now and experience the future of banking.

Rate the App

Popular Apps