smallcase: Stocks, MFs, FDs

6.44.1 by smallcase - Stock Portfolios, Mutual Funds, FDs (0 Reviews) September 16, 2024Latest Version

6.44.1

September 16, 2024

smallcase - Stock Portfolios, Mutual Funds, FDs

Finance

Android

0

Free

com.smallcase.android

Report a Problem

More About smallcase: Stocks, MFs, FDs

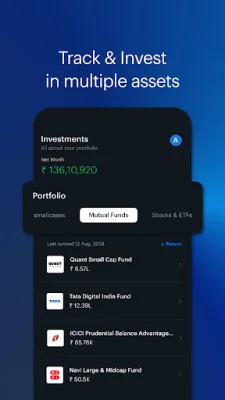

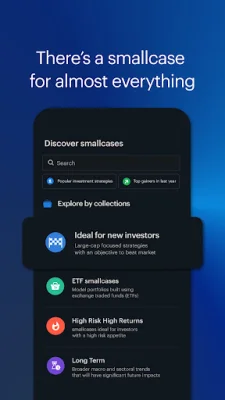

Smallcase is a comprehensive investment app that allows users to make the most out of their money. It offers a variety of features that make investing easy and accessible for everyone. With smallcase, users can invest in different asset classes such as stock portfolios, single stocks, mutual funds, and fixed deposits. All of these investments can be tracked in one place, making it convenient for users to keep an eye on their portfolio.

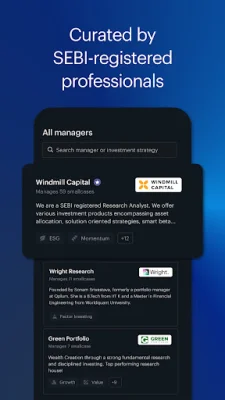

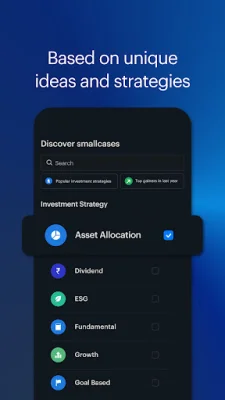

One of the main features of smallcase is the ability to invest in multiple assets. Users can choose from over 500 ready-made stock portfolios based on popular themes, sectors, and strategies. These portfolios are created and managed by SEBI-registered investment experts, giving users peace of mind and confidence in their investments. Users can also explore different investment ideas based on their risk profile and goals, such as retirement or buying a house.

Smallcase also allows users to invest in individual stocks or create their own smallcase. This feature is perfect for those who want more control over their investments. Additionally, users can easily set up SIPs (Systematic Investment Plans) into multiple stocks with just one tap. And for those who already have a broking account, there's no need to open a new one - they can simply connect their existing DEMAT account to the app.

In addition to stocks, smallcase also offers direct mutual funds with zero commission fees. Users can compare different mutual funds based on returns, expense ratio, and volatility. The app also provides the option to open high-interest fixed deposits with returns up to 9.1%, with DICGC insurance up to 5 lakhs. Users can open these deposits with their existing bank account, making it a hassle-free process.

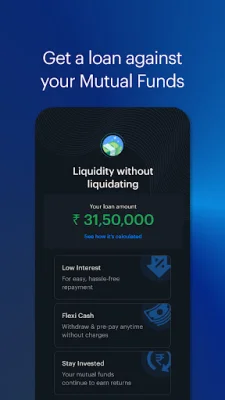

One of the unique features of smallcase is the ability to get a loan against mutual fund investments. This allows users to get cash for their short-term needs without having to sell their investments. The loan process is completely online and can be completed in under 3 hours, with low interest rates and no charges for early closure. This feature gives users more flexibility and control over their investments.

Overall, smallcase is a powerful investment app that offers a wide range of features to help users make the most out of their money. It allows for easy and convenient investing across multiple assets, tracking of investments in one place, and even the option to get a loan against mutual fund investments. With smallcase, users can do more with their money and achieve their financial goals.

Rate the App

Popular Apps