Union Bank VT & NH Mobile

25.6.0 by Union Bank Mobile Banking (0 Reviews) November 05, 2025Latest Version

25.6.0

November 05, 2025

Union Bank Mobile Banking

Finance

Android

0

Free

com.fi6086.godough

Report a Problem

More About Union Bank VT & NH Mobile

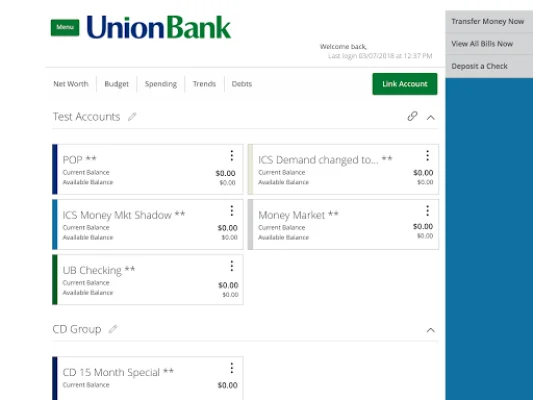

The Union Bank mobile app offers a variety of features to help manage your finances conveniently and securely. With this app, you can easily access and manage your Union Bank accounts, transfer funds, deposit checks, pay bills, and utilize personal financial management tools. Additionally, business customers can take advantage of features such as ACH transfers and fraud prevention tools. The app also includes a locator for ATMs and branches, as well as secure messaging and alerts for account activity.

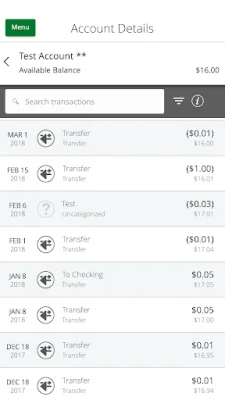

One of the main features of the Union Bank mobile app is account management. This allows you to view your account balances, review recent transactions, and search transaction history. You can also transfer funds between your Union Bank accounts and accounts with other financial institutions, as well as sign up for eStatements and view cleared check images. The app also allows you to view your credit card transactions, making it easy to keep track of your spending.

The app also offers a convenient funds transfer feature, allowing you to send and receive money using Person to Person (P2P) with friends, family, or anyone with a debit card or mobile phone number. You can also transfer funds between your Union Bank accounts and accounts with other financial institutions, as well as transfer funds to others with accounts at Union Bank. Transfers between Union Bank accounts are immediate and P2P transfers are secure and free.

Another useful feature of the Union Bank mobile app is the ability to deposit funds electronically. This allows you to deposit checks from your smartphone by simply taking a picture of the check and entering the amount. The deposit will appear in your account immediately, making it a quick and secure way to manage your funds.

The app also offers a bill payment feature, allowing you to pay bills, view recently paid bills and scheduled payments, and set up one-time or recurring payments for multiple payees. You can also enjoy enhanced bill payment options, such as adding, editing, and deleting payees.

For those looking to manage their finances more closely, the app offers a personal financial management tool. This allows you to view all account balances from multiple financial institutions in one convenient location, create a budget, and track your income and spending habits. You can also review transactions by spending categories from all of your Union Bank accounts and any other accounts you choose to include.

Business customers can also benefit from the Union Bank mobile app, with features such as creating and approving ACH transfers, enhanced approval levels, and fraud prevention tools like Positive Pay. The app also offers a locator for ATMs and branches, as well as secure messaging and alerts for account activity. With 128-bit SSL encryption and Touch Authentication for login, the app prioritizes security to protect your financial information.

Rate the App

Popular Apps