DEEPBLUE Debit

6.8.2 by NetSpend (0 Reviews) October 30, 2025Latest Version

6.8.2

October 30, 2025

NetSpend

Finance

Android

0

Free

com.netspend.mobileapp.deepbluedebit

Report a Problem

More About DEEPBLUE Debit

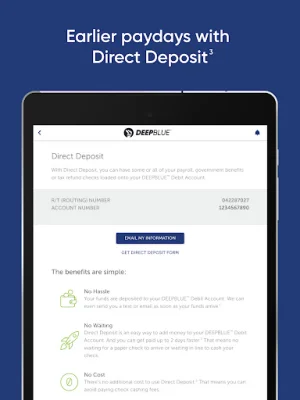

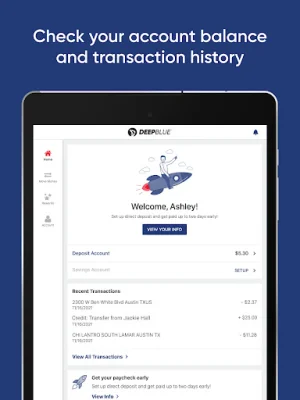

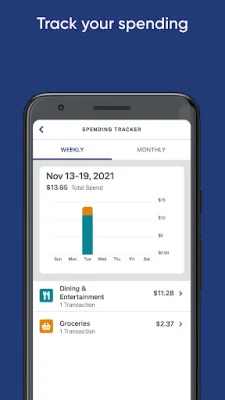

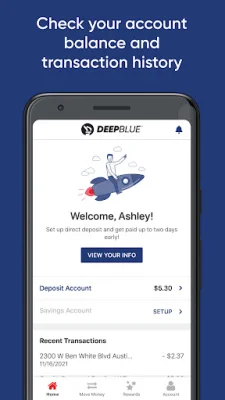

The DEEPBLUE™ Debit Account is a convenient and secure way to manage your payroll or benefit payments. With Direct Deposit, you can receive your payments up to 2 days earlier than traditional methods. This account also allows you to easily check your balance and transaction history, as well as send money to family and friends. Additionally, you have the option to enroll in the Overdraft Service, which can cover transactions that overdraw your account by more than $10, up to a maximum of five fees per month.

Opening a DEEPBLUE™ Debit Account is subject to registration and ID verification. During registration, you will be asked to provide your name, address, date of birth, and government ID number. You may also be required to show your driver's license or other identifying information. This account can be used anywhere Debit Mastercard®️ is accepted, making it a convenient option for everyday purchases.

By using Direct Deposit, you can receive your tax refunds faster compared to traditional methods. This account also offers a faster ACH processing policy, which means your funds will be available sooner. You can also use the Mobile Check Capture service to deposit checks into your account, with approval usually taking only 3-5 minutes.

The Debit Card Overdraft Service is an optional feature that can be added to your DEEPBLUE™ Debit Account. This service is provided by Republic Bank & Trust Company and can cover transactions that overdraw your account. However, there is a fee of $20 for each transaction that overdraws your account by more than $10. You have 24 hours from the time of the first overdraft transaction to bring your account back to a positive balance to avoid this fee. It's important to note that not all transactions are eligible for coverage under this service.

The DEEPBLUE™ Debit Account is offered by Republic Bank & Trust Company, with Netspend as the service provider. This account can be used anywhere Debit Mastercard is accepted and certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Fees, terms, and conditions apply, so it's important to review all details before enrolling. Overall, this account offers a convenient and secure way to manage your finances and access your funds.

Rate the App

Popular Apps