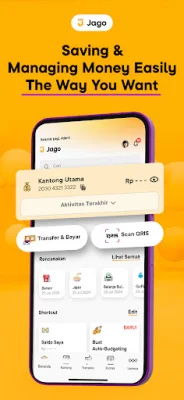

Jago/Jago Syariah digital bank

8.50.0 by PT Bank Jago Tbk (0 Reviews) September 26, 2024Latest Version

8.50.0

September 26, 2024

PT Bank Jago Tbk

Finance

Android

0

Free

com.jago.digitalBanking

Report a Problem

More About Jago/Jago Syariah digital bank

The Bank Jago app offers a wide range of benefits for its users. With this app, you can easily open a new bank account in just a few minutes without any minimum balance or monthly fees. It also allows you to organize your spending and savings with up to 60 personalized pockets, making it easier to manage your finances.

One of the many perks of using the Bank Jago app is the free GoPay top-up fee. You can also enjoy free bank transfers up to 150 times and ATM withdrawals up to 10 times. The app also offers super fast and cheap transfers with BI-FAST, making it convenient and cost-effective to send money to other banks.

The app also offers a quick and easy way to pay for your purchases with Jago QRIS. You can simply scan and pay, making transactions faster and more convenient. Additionally, you can withdraw cash anywhere and shop online with your Jago Visa or GPN Debit Card.

Aside from these features, the Bank Jago app also allows you to pay bills, top up your phone, and even donate to charity, all in one place. It also offers Jago Deposits, where you can save for the future with competitive interest rates and the flexibility to withdraw your money anytime without penalties.

The app also offers various promotions for both new and loyal users. It also allows you to connect with other financial services such as Bibit, Gobiz, and GoPay, making investing and spending a breeze.

With the Bank Jago app, you can do everything from your smartphone, making it a convenient and efficient way to manage your finances. The app also prioritizes the safety and security of its users, with multi-layer security systems and biometric or PIN protection for access and transactions. It also offers a safe and secure way to withdraw cash at ATMs and make purchases worldwide with its Visa and GPN Debit Cards.

For those who prefer to manage their finances according to Sharia principles, the Bank Jago app offers a full suite of features that comply with Islamic guidelines. It also offers 60 Jago Syariah Pockets, allowing you to manage your savings and expenses in a Sharia-compliant manner. The app is licensed and supervised by the Financial Service Authority, Bank Indonesia, and is a member of the LPS deposit insurance program, providing a trusted option for managing finances.

Rate the App

Popular Apps