Lloyds Bank Business

147.03 by Lloyds Banking Group PLC (0 Reviews) September 20, 2024Latest Version

147.03

September 20, 2024

Lloyds Banking Group PLC

Finance

Android

0

Free

com.lloydsbank.businessmobile

Report a Problem

More About Lloyds Bank Business

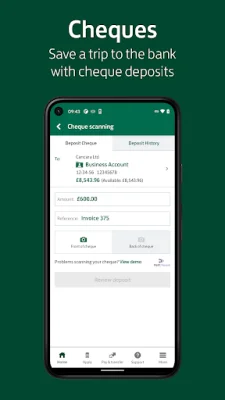

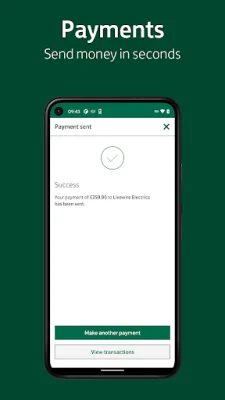

The Lloyds Bank mobile app allows business account holders to easily and securely manage their finances on the go. Users can log in quickly using their fingerprints, Face Authentication, or memorable information. The app offers a range of features, including the ability to pay in cheques up to £10,000 per day and make payments of up to £250,000 per day. Users can also add new payment recipients, view their PIN number for their business debit card, and create and amend standing orders.

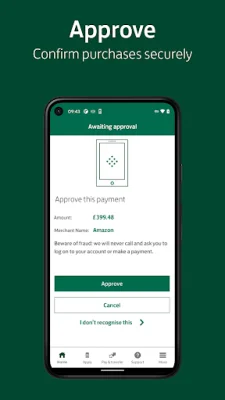

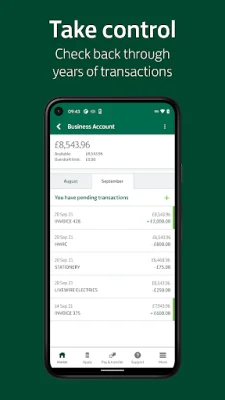

In addition, the app allows users to transfer money between their business accounts, check their account balances and transaction details, and sign up for paper-free settings with the Digital Inbox feature. Users can also view and delete Direct Debits, search their transactions, and update their business and personal address. For international transactions, users can make payments to existing recipients and approve online purchases.

To get started with the app, users will need a Lloyds Bank business account and their Internet Banking logon details. They will also need a card and card reader. If they are not yet registered for Internet Banking, they can do so on the bank's website. And if they do not have an account with Lloyds Bank, they can apply for one directly through the app.

The app prioritizes the safety and security of its users' information and money. It uses the latest online security measures to protect against fraud and unauthorized access. The app also checks the user's device and software for security before allowing them to log in. In case of a lost or stolen phone, the app can block access to the user's accounts.

However, users should note that their phone's signal and functionality may affect the app's service. The app also collects anonymous location data to improve its services and prevent fraud. It is important to note that the app cannot be used in certain countries, including North Korea, Syria, Sudan, Iran, and Cuba, due to technology export prohibitions.

In conclusion, the Lloyds Bank mobile app offers a convenient and secure way for business account holders to manage their finances. With a range of features and a focus on safety, the app is a valuable tool for any business owner.

Rate the App

Popular Apps