Spruce - Mobile banking

4.30.0 by H&R Block Digital Tax (0 Reviews) October 29, 2025Latest Version

4.30.0

October 29, 2025

H&R Block Digital Tax

Finance

Android

0

Free

com.hrblock.sprucemoney

Report a Problem

More About Spruce - Mobile banking

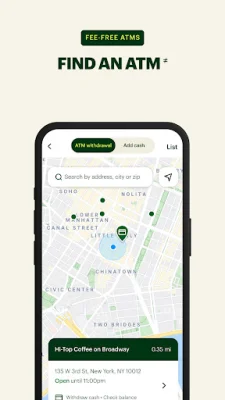

Looking for a high-yield savings option? Check out Spruce Savings and opt in to earn 3.50% APY* on your account. With Spruce, you can easily manage your finances, transfer money, and deposit checks all within the app‡. Plus, enjoy benefits such as no sign-up fees, no monthly fees, no minimum balance requirements, and no credit check.

But that's not all - Spruce also helps you set financial goals and save money in a smart way. You can set a Saving Goal in the app and use automated deposits to make it easier to reach your goal. And with the option to opt in for 3.50% APY*, your money can work even harder for you.

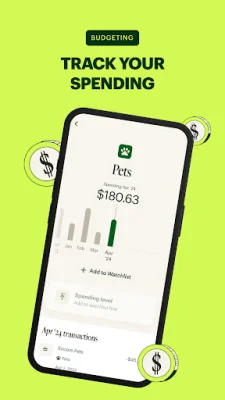

Not sure where your money is going? Let Spruce categorize your transactions and use the Watchlist feature to keep track of spending and set monthly income goals.

Ready to get started? Follow these quick tips: download the Spruce mobile banking app, create a secure password, sign up for Spruce Spending and Savings accounts, and explore the navigation menu to see your balances, review transactions, move money, create Saving Goals, and check your credit score.

It's important to note that Spruce is not a bank, but a financial technology platform built by H&R Block. The Spruce debit card is issued by Pathward, N.A., Member FDIC, and is licensed by Mastercard®. Your funds are insured by the FDIC on a pass-through basis, and Spruce and H&R Block are not FDIC-insured institutions. Additionally, Spruce offers a separate credit score service provided by Pathward, N.A. and courtesy coverage for certain transactions.

So why wait? Start managing your finances and saving money the smart way with Spruce today!

Rate the App

Popular Apps